The relationship between President Trump and the Federal Reserve has been a focal point of economic discourse, particularly during his presidency when he openly criticized the Fed’s monetary policy decisions and its Chair, Jerome Powell. Trump frequently expressed frustration over what he perceived as Powell’s reluctance to aggressively cut interest rates, arguing that such hesitation hindered economic growth. This tension reached a peak when rumors circulated that Trump was contemplating firing Powell, prompting concerns about the potential impact on Federal Reserve independence. Analysts warned that such an unprecedented move could undermine the credibility of the Fed, leading to severe market reactions. As the debate over the balance of power between the executive branch and the Federal Reserve continues, the ramifications of Trump’s decision-making remain a critical topic for both policymakers and investors.

The dynamic between the White House and the nation’s central banking system has drawn significant attention over the years, especially regarding recent policy decisions and leadership styles. Many have pondered whether Trump’s controversial stances could affect the appointment and tenure of the Federal Reserve’s chairman, previously appointed by himself, Jerome Powell. Such discussions raise fundamental questions around central bank autonomy and the broader implications for economic strategies. As various stakeholders analyze the potential shifts in governance, the financial markets remain particularly sensitive to changes in monetary policy and leadership paradigms. This ongoing narrative not only shapes the economic landscape but also influences investor confidence and market stability.

The Implications of Trump Firing Jerome Powell

The prospect of President Trump firing Federal Reserve Chairman Jerome Powell has raised significant concerns regarding the independence of the Federal Reserve. President Trump’s public criticism of Powell’s monetary policy decisions has led many to speculate about the potential consequences of removing him from office. A move to fire Powell not only risks undermining the established autonomy of the Fed but could also trigger panic in the financial markets. Analysts emphasize that a change in leadership under these circumstances could signal an attempt to manipulate monetary policy for short-term political gains rather than maintaining economic stability.

Moreover, the independence of the Federal Reserve is a fundamental principle that helps to anchor economic decision-making, particularly regarding inflation control and interest rates. Firing Powell could disrupt the established operations of the Fed and invoke a crisis of confidence among investors. The risk of market volatility could further escalate, particularly if there is widespread belief that a new chairman would implement more lenient monetary policies in line with administration preferences. Hence, any discussion surrounding the removal of Powell must carefully consider the broader implications on both the economy and the market.

Federal Reserve Independence: A Critical Discussion

The independence of the Federal Reserve is integral to maintaining a balanced monetary policy that is insulated from political pressures. This independence allows the Fed to make decisions based on economic data rather than political expediency, helping to preserve inflation targeting, which currently stands at 2%. If President Trump were to fire Powell, the implications for Federal Reserve independence could be profound. Historical precedents demonstrate that political interference in central banking operations can lead to adverse outcomes such as increased inflation and economic instability.

Legal interpretations surrounding the potential for the president to dismiss a Fed chairman underlines the complexity of this issue. While some argue that the president has broad authority, the nature of the Federal Reserve suggests that maintaining its independence is vital for effective governance. Any threat to the Fed’s integrity not only risks the credibility of U.S. monetary policy but may also lead to greater volatility in financial markets. In essence, protecting the Fed’s independence is paramount for upholding the effectiveness of America’s economic strategies.

Market Reactions to Fed Chair Decisions

Market reactions to the news of possible changes in the Federal Reserve’s leadership are often swift and pronounced. The financial markets thrive on predictability; any indication that there may be a shift in the Fed’s chair can lead to knee-jerk reactions among investors. Historical examples illustrate that significant market shifts can occur in response to mere speculation about leadership changes, with fears of stricter monetary policies or an unqualified replacement contributing to sell-offs in equity markets.

Moreover, the identity of a replacement Fed chair holds substantial significance for investors who evaluate potential shifts in monetary policy. If Trump were to nominate a successor perceived as more willing to accommodate his economic agenda, markets could react unfavorably, fearing inflationary consequences. Conversely, if Powell were to serve out his term, it could signal a commitment to continuity, potentially easing investor anxieties and stabilizing markets.

Understanding Jerome Powell’s Role as Fed Chairman

Jerome Powell’s role as the Federal Reserve Chairman extends beyond being simply a figurehead in the Federal Reserve system. He is tasked with leading monetary policy discussions and guiding the decisions of the Federal Open Market Committee (FOMC). His past decisions and communication style have influenced market expectations and investor sentiment significantly. Many analysts have argued that Powell’s approach has centered on achieving a balance between supporting economic growth and safeguarding against inflation, which has been crucial in a post-pandemic economy.

The chair’s influence on policy decisions underscores the importance of careful deliberation within the FOMC. Powell’s expertise and his relationships with other board members contribute to consensus-building on monetary policies. Following through on policies that guide interest rates and broader economic strategies is essential for market trust. Consequently, any attempts to unseat Powell could disrupt not only his leadership but also the careful consideration that defines the Fed’s approach to maintaining economic stability.

Federal Reserve’s Monetary Policy Impact

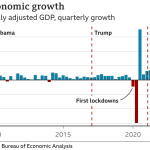

The Federal Reserve’s monetary policy decisions have profound implications for economic outcomes, influencing everything from consumer spending to investment strategies. By adjusting interest rates, the Fed aims to control inflation while supporting employment rates. Under Powell’s leadership, the Fed has sought to navigate the complexities of economic recovery amid challenges such as global trade uncertainties and inflationary pressures. Critics argue that not acting aggressively enough can hinder growth, a sentiment echoed by President Trump’s critiques of Powell’s policy framework.

Moving forward, the Fed’s ability to respond to changing economic indicators while maintaining its independence becomes increasingly critical, especially amidst potential political influences. Any potential removal of Powell would not only signal a shift in policy direction but could also lead to a fundamental re-evaluation of how monetary policy is perceived by the markets and the public alike. Ensuring that the Fed operates without external pressures is essential for safeguarding the stability of the economy in the long term.

Analyzing Trump’s Criticism of Federal Reserve Policy

President Trump’s ongoing criticism of Jerome Powell and the Federal Reserve has focused on the perceived inadequacies in monetary policy and interest rate decisions. Trump has publicly expressed his discontent with the pace of rate cuts, leading to speculation about whether he would attempt to replace Powell before the end of his term. Such public pressure raises questions about the ability of the Fed to operate independently from political motivations, potentially complicating future monetary policy decisions.

Furthermore, Trump’s focus on competitive interest rates highlights a broader desire to promote economic growth at the expense of long-term inflation considerations. While some argue that there may be merit in advocating for more aggressive cuts, the overarching consensus among economists is that the Fed should prioritize maintaining its credibility and independence. Therefore, Trump’s approach may risk undermining the holistic goals of monetary policy, placing greater emphasis on immediate political advantages over sustainable economic health.

Jerome Powell’s Legacy and Future at the Federal Reserve

As Jerome Powell nears the end of his term, discussions around his legacy and the potential for successorship are becoming increasingly relevant. Powell’s navigation through unprecedented economic challenges, including the pandemic and subsequent recovery efforts, has highlighted his commitment to maintaining stability while responding to inflationary concerns. His decisions, while at times contentious with political figures, have generally reflected an adherence to the core tenets of Federal Reserve independence.

Should Powell be allowed to finish his term, he may leave behind a legacy characterized by resilience and adaptability in the face of economic adversity. Observers of the Federal Reserve suggest that his successor will face similar pressures and expectations, particularly regarding any potential shifts in monetary policy. Thus, as the debate surrounding Powell’s position unfolds, the implications for both the Federal Reserve and the broader economy become a critical focal point for investors and policymakers alike.

Trump’s Economic Agenda and Federal Reserve Dynamics

President Trump’s economic agenda has often included a call for more aggressive monetary policy to stimulate growth, significantly impacting the dynamics within the Federal Reserve. His public discussions about rates and monetary easing reflect a desire to influence Fed decisions, potentially challenging its independence. The tension between a sitting president and the Federal Reserve chair can lead to uncertainty and volatility in financial markets, emphasizing the importance of maintaining a clear boundary between political objectives and independent monetary policy.

The interaction between Trump’s economic agenda and Federal Reserve dynamics is crucial as it shapes market perceptions and responses. Investors closely watch these interactions, assessing how they might impact interest rates and economic growth. With each tweet or public statement from Trump about the Fed, market participants recalibrate their expectations which can lead to broader economic repercussions. Therefore, the relationship between the executive branch and the Federal Reserve remains a vital area of focus for economists and investors alike.

The Role of the Supreme Court in Fed Chair Removal

The Supreme Court’s role in determining the legality of firing a Federal Reserve chair adds another layer of complexity to discussions surrounding Trump and Jerome Powell. With recent rulings indicating a shift in how executive authority is viewed, the court may play a pivotal role in clarifying whether a president holds the power to remove a chairman from an independent agency. Observers note that such a judicial precedent could either reinforce the Fed’s traditional independence or suggest a more expansive interpretation of executive powers.

The potential implications for the Federal Reserve are significant, particularly if the Supreme Court were to issue rulings that challenge the historical understanding of independence in federal agencies. Any ruling in favor of stronger presidential authority could lead to challenges in maintaining the Fed’s credibility and stability. As the administration navigates its relationship with the Fed, legal interpretations by the courts will shape perceptions of both the Fed’s authority and its ability to function without political interference.

Frequently Asked Questions

Can Trump fire Federal Reserve Chairman Jerome Powell?

President Trump has historically hinted at the possibility of firing Jerome Powell, the Federal Reserve Chairman he appointed in 2017. Legally, the president does have the power to remove Fed governors, but whether this extends to the chairman depends on interpretations of the Federal Reserve Act and Court decisions. It’s crucial to note that such an action could severely undermine the Federal Reserve’s independence and trigger negative market reactions.

What would happen if Trump decided to remove Powell from the Fed?

If President Trump were to remove Jerome Powell from his position, the market reaction could be quite severe. Traders and analysts fear that such a move would signal an attempt to influence monetary policy, potentially leading to higher inflation rates. The Fed’s independence is vital for maintaining trust and credibility, and any removal of the chair could result in increased long-term interest rates.

What is the relationship between Trump and the Federal Reserve’s monetary policy?

President Trump’s relationship with the Federal Reserve has been contentious, primarily due to differing views on monetary policy. Trump has often criticized Powell for not being aggressive enough with interest rate cuts, suggesting that a more accommodative policy is preferable for immediate economic growth. This friction highlights the delicate balance between presidential influence and the Fed’s independence.

How do recent Supreme Court decisions affect Trump’s ability to fire Powell?

Recent decisions by the Supreme Court may affect interpretations of removal powers concerning independent agency leaders, such as the Federal Reserve Chairman. Previous rulings, particularly those challenging the ‘for cause’ protections afforded to agency heads, suggest that the Court might be open to a more expansive view on presidential authority to remove officials like Powell, although this remains a complex legal issue.

What impact does the potential firing of Powell have on the markets?

The financial markets tend to react negatively to the uncertainty surrounding the potential firing of Jerome Powell. Such an act is viewed as a threat to the independence of the Federal Reserve, which could undermine its credibility in managing inflation. This could lead to a rise in long-term interest rates, as investors demand a higher risk premium for holding longer-term debt.

What constitutes ’cause’ for firing the Federal Reserve Chair?

Under the Federal Reserve Act, governors can be removed ‘for cause,’ but the specific grounds for this removal, especially concerning the chair, are not clearly defined in the law. Legal experts debate whether the president can remove Powell without a clear statutory basis, especially considering recent legal precedents questioning the limits of presidential authority over independent agencies.

How does Trump’s views on interest rates affect the Federal Reserve?

Trump’s views on interest rates often lean towards favoring lower rates to stimulate economic growth. He has publicly criticized the Federal Reserve for maintaining higher rates, arguing that it hinders economic expansion. However, this stance contrasts with the Fed’s mandate to ensure long-term economic stability, which may involve higher interest rates to combat inflation.

What would be the market ramifications if Trump fired Powell?

If Trump were to fire Powell, the immediate market ramifications would likely include increased volatility and rising interest rates. Investors could react to fears of a politically influenced central bank, leading to a loss of confidence in the Fed’s commitment to controlling inflation, thus causing a significant sell-off in the bond markets.

| Key Points |

|---|

| Trump’s Difficult Relationship with Powell |

| Concerns Over Inflation and Growth |

| Trump’s Consideration of Ousting Powell |

| Legal Ambiguity in Fed Chair Removal |

| Supreme Court’s Potential Stance |

| Market Reaction to Removal Threats |

| Federal Reserve’s Independence and Impact on Policy |

| Importance of Monetary Policy in Economic Stability |

| Potential Issues with Successor’s Impact on Markets |

Summary

Trump and the Federal Reserve have had a tumultuous relationship, characterized by disagreements over monetary policy and the potential for Trump to remove Fed Chairman Jerome Powell. The ongoing concerns regarding inflation, economic growth, and the overall independence of the Federal Reserve are paramount in this discussion. Trump’s threats to dismiss Powell have elicited significant market reactions, suggesting that any such move could undermine the Fed’s credibility and its ability to manage inflation effectively. In conclusion, while the legal frameworks surrounding the removal of the Fed chair are complex and somewhat ambiguous, the implications of such actions could resonate profoundly across financial markets and the broader economy.