Stefanie Stantcheva, a groundbreaking economist at Harvard, has made headlines as the recipient of the prestigious 2025 John Bates Clark Medal, an esteemed accolade awarded to economists under 40 for their impactful contributions. Her innovative research in the realm of tax policy offers vital insights into how taxation shapes economic behavior and fosters or stifles innovation. Stantcheva articulates that a well-designed tax system can be a powerful tool for economic growth, emphasizing its critical role in encouraging creativity and entrepreneurship. With her work in public finance research, she has successfully demonstrated the significant correlation between tax policies and innovation dynamics through studies like “Taxation and Innovation in the 20th Century.” As a leader in her field, Stantcheva’s expertise not only enhances academic discourse but also informs essential policy discussions that could redefine the future of economics.

Introducing Stefanie Stantcheva, a prominent figure in the economic landscape, her receipt of the John Bates Clark Medal highlights her pivotal role as a thought leader among young economists. This Harvard professor’s research delves deep into the effects of fiscal policy on innovation and public finance, providing valuable perspectives on how economic mechanisms influence societal progress. Recognized not just for her academic achievements, Stantcheva’s exploration of the intersection between taxation and entrepreneurial activity sheds light on crucial topics such as economic mobility and trade policy. Her work encapsulates the essence of contemporary economic challenges, investigating how tax frameworks can either spur or inhibit growth and creativity. As we navigate an evolving economic environment, insights from economists like Stantcheva will be indispensable in crafting effective policy solutions.

Understanding the John Bates Clark Medal

The John Bates Clark Medal is one of the most prestigious awards in economics, presented annually to an outstanding economist under the age of 40. It recognizes innovative and impactful research contributions that advance the understanding of economic theory and policy. This award not only honors individual excellence but also promotes fresh perspectives within the field. Notably, past recipients of the medal have emerged as influential leaders in economic thought, making substantial contributions to areas such as public finance and social welfare.

Awarding the John Bates Clark Medal to economists signifies acknowledgment of their potential for future contributions to the discipline. The ability to shed light on pressing economic issues is crucial, especially in an era marked by challenges in tax policy and public finance. The insights garnered from this award often inspire new research directions and enhance the discourse surrounding pivotal economic questions.

Stefanie Stantcheva’s Contributions to Tax Policy

Stefanie Stantcheva’s recent work provides deep insights into the complex relationship between tax policy and economic innovation. Her acclaimed study, co-authored in 2022, highlights how changes in tax policy can significantly influence the rate and quality of innovation within an economy. By demonstrating that innovation responds with high elasticity to tax variations, Stantcheva’s research emphasizes the critical importance of tax design in fostering a healthy economic climate.

Furthermore, Stantcheva elucidates the dichotomy between the quantity and quality of innovation under different tax regimes. Her findings suggest that while higher taxes tend to diminish the number of innovative projects pursued, they do not inherently reduce the caliber of the inventions produced. These insights propose that to stimulate economic activity, policymakers must create a balance that encourages innovation while still generating necessary tax revenues.

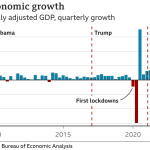

The Impact of Innovation on Economic Growth

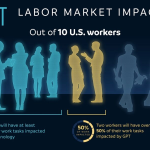

Innovation has long been recognized as a key driver of economic growth and prosperity. It plays a critical role in enhancing productivity and creating new markets, which in turn can lead to job creation and increased income levels. Economic policies, particularly those governing taxation, directly impact the incentivization of innovative activities. As such, understanding how innovation interacts with tax policy is vital for fostering a thriving economy.

Research indicates that well-designed tax policies can stimulate innovations and harness the entrepreneurial spirit of a nation. By offering incentives that encourage research and development, governments can actively influence the rate at which new technologies and ideas emerge. Therefore, economists and policymakers must carefully consider the implications of tax structures on innovation to ensure sustained economic advancement.

Public Finance Research and its Importance

The field of public finance research delves into the revenue collection and expenditure practices of governments, serving as a foundation for effective economic management. Studies in public finance address how tax policies can be structured to achieve desired economic outcomes, such as social equity and efficient resource allocation. This research informs policy decisions, ensuring that they align with broader economic goals.

Public finance insights are particularly valuable in times of economic uncertainty, where effective resource distribution becomes critical. Economists like Stefanie Stantcheva utilize this field to evaluate contemporary issues in tax policies and their impacts on behavior and innovation. The findings derived from public finance research guide policymakers in crafting solutions that address both short-term challenges and long-term economic stability.

Innovating Tax Policies for Future Generations

As the global economy evolves, the need for innovative tax policies becomes more evident. Tax systems must adapt to address emerging challenges related to technology, globalization, and socio-economic disparities. Innovative tax policies can ensure that taxation levels remain fair and that they effectively fund essential public services while promoting growth and investment.

Moreover, with advancements in data analytics and economic modeling, the potential to design more effective tax policies is greater than ever. Policymakers have the opportunity to use empirical data to understand better how different tax rates affect economic behavior and innovation. Embracing innovative approaches to tax policy will be crucial for fostering a sustainable economy that benefits future generations.

Stefanie Stantcheva and Behavioral Economics

Stefanie Stantcheva’s work also traverses the intersecting fields of behavioral economics, where she examines how psychological factors impact economic decisions. Understanding public perceptions of taxes and government policies can inform how these policies are designed and implemented. Her focus on behavioral insights is essential in creating tax systems that resonate with individuals’ values and motivations.

By incorporating behavioral economics into public finance research, Stantcheva aims to bridge the gap between traditional economic theories and real-world behavior. This approach highlights the necessity of considering human psychology in economic modeling, particularly regarding taxation and compliance, fostering a holistic understanding of economic interactions.

The Role of Educational Institutions in Economic Research

Institutions like Harvard University play a pivotal role in advancing economic research by nurturing innovative thinkers like Stefanie Stantcheva. Such academic environments foster collaboration across disciplines, allowing economists to explore complex issues efficiently. Harvard’s Economics Department, celebrated for its successful alumni and innovative research contributions, is integral to the broader economic discourse.

Moreover, leading educational institutions often serve as incubators for groundbreaking ideas that address pressing societal challenges. By encouraging research in public finance and tax policy, these institutions contribute significantly to shaping effective economic strategies that enhance societal welfare and stimulate innovation.

Future Perspectives in Tax Policy Design

Looking ahead, the design of tax policies must prioritize adaptability and responsiveness to ongoing economic changes. The rise of digital economies and new business models calls for innovative approaches to taxation that ensure equity and efficiency. Policymakers, inspired by economists’ research, must rethink existing frameworks to accommodate the challenges posed by rapid technological advancements.

Furthermore, as the global context continues to evolve, international cooperation in tax policy design becomes essential. Collaborative efforts among nations can lead to more consistent and equitable tax practices that support sustainable global economic growth. Ultimately, a focus on innovation in tax policy can provide a framework that is both dynamic and effective for dealing with future economic challenges.

Integrating Tax Insights into Economic Strategy

Integrating insights from tax policy research into broader economic strategies can significantly enhance governance and economic planning. By leveraging data and research findings, leaders can devise tax systems that not only raise revenue but also bolster economic resilience and innovation. For instance, understanding the elasticity of innovation in response to tax changes can enable governments to craft regulations that optimally balance fiscal needs with growth imperatives.

Moreover, adopting a comprehensive view of tax strategies allows governments to foster a productive environment for businesses and innovators. As Stantcheva emphasizes, careful consideration of the impacts of taxation on economic activities is crucial—especially in a context demanding continuous innovation. This integration ultimately leads to more robust economic performance and improved societal outcomes.

Frequently Asked Questions

What are Stefanie Stantcheva’s notable contributions to tax policy?

Stefanie Stantcheva has made significant contributions to tax policy through her research in public finance, particularly demonstrated in her award-winning paper, “Taxation and Innovation in the 20th Century.” Her insights reveal how tax policy impacts innovation, showing that higher taxes can negatively affect the quantity of innovation while not compromising the quality of inventions, highlighting the critical role of tax design in fostering economic growth.

Why did Stefanie Stantcheva win the John Bates Clark Medal?

Stefanie Stantcheva won the John Bates Clark Medal for her pioneering insights into tax policy, innovation, and economic behavior. Recognized as a leading economist under 40, her research has profoundly impacted the understanding of how tax systems influence economic activity, innovation dynamics, and societal choices regarding public finance.

How does Stefanie Stantcheva’s work relate to innovation and taxes?

Stefanie Stantcheva’s research highlights the relationship between tax policy and innovation, arguing that a well-designed tax system can encourage innovation while poorly structured taxes may hinder economic activity. Her findings, particularly those from her 2022 paper, underline that changes in tax policy significantly affect the responsiveness of innovation.

What is the focus of the Social Economics Lab founded by Stefanie Stantcheva?

The Social Economics Lab, founded by Stefanie Stantcheva in 2018, focuses on understanding economic issues and policies through a social lens. The lab explores the impact of emotions on economic policy, social mobility, climate change, and immigration, employing innovative approaches to decipher complex interactions in public finance and human behavior.

What impact does tax policy have on innovation according to Stefanie Stantcheva’s research?

According to Stefanie Stantcheva’s research, tax policy has a profound impact on innovation, with evidence suggesting that higher taxes can reduce the quantity of innovative activities. However, her studies indicate that while taxation can limit innovation levels, it does not necessarily affect the quality of the innovations produced, emphasizing the importance of tax structure in promoting a robust economic environment.

What is the significance of the John Bates Clark Medal in economics, particularly for someone like Stefanie Stantcheva?

The John Bates Clark Medal is a prestigious award given by the American Economic Association to an economist under 40 who has made significant contributions to the field. For someone like Stefanie Stantcheva, winning this medal not only acknowledges her groundbreaking work in tax policy and innovation but also enhances her visibility and influence in the economic community, recognizing her as a leading voice in public finance research.

| Key Points | Details |

|---|---|

| Award Recognition | Stefanie Stantcheva won the 2025 John Bates Clark Medal, awarded annually to an under-40 economist for significant contributions. |

| Award Impact | The award recognizes her pioneering insights on tax policy, innovation, and economic behavior. |

| Research Focus | Stantcheva’s work addresses public finance, including the effects of tax policy on innovation and economic dynamics. |

| Key Findings | Her study found that innovation responds to tax changes with high elasticity, showing that while higher taxes may negatively impact the quantity of innovation, they do not affect the quality of inventions. |

| Social Economics Lab | Founded in 2018, the lab focuses on understanding economic issues, including the interplay between emotions and policy. |

| Future Research | Stantcheva is exploring new topics, including social mobility, immigration, and climate change. |

Summary

Stefanie Stantcheva’s recent recognition with the John Bates Clark Medal underscores her trailblazing contributions to economics, particularly in the realms of tax policy and innovation. Her research not only highlights the critical role of effective tax systems in fostering economic activity but also sets the stage for future inquiries into how beliefs and emotions influence economic decision-making. As she continues her work at the Social Economics Lab, the field eagerly anticipates her next groundbreaking findings.