Corporate tax cuts have been a contentious topic among policymakers and economists, especially in the wake of the 2017 Tax Cuts and Jobs Act. This legislation was touted as a catalyst for economic growth, reducing corporate tax rates from 35% to 21%, yet subsequent tax policy evaluation reveals a mixed bag of results. Notably, Gabriel Chodorow-Reich’s analysis highlights both modest increases in wages and business investments, but also a significant decline in federal tax revenue. As Congress approaches critical decisions regarding the renewal of these tax cuts, the economic impact of tax cuts on business behavior continues to spark debate. Ultimately, understanding the effects of the TCJA and its ongoing implications is essential for shaping future fiscal policies and navigating the upcoming tax battle in 2025.

The discussion surrounding reductions in corporate taxation often employs terms like “business tax reductions” and “corporate rate adjustments.” These changes, particularly highlighted by the 2017 Tax Cuts and Jobs Act, have significant implications for federal revenue and economic growth. An extensive analysis by experts, including Chodorow-Reich, seeks to unpack the results of these tax reforms, revealing insights into how such fiscal measures affect investments and wages. As the expiration of pivotal tax provisions looms, the economic landscape stands at a crossroads, demanding a thorough examination of the strategies employed to incentivize corporate profitability. Evaluating these shifts is crucial for understanding their broader impact on the economy and public welfare.

Understanding the 2017 Tax Cuts and Jobs Act

The 2017 Tax Cuts and Jobs Act (TCJA) marked a significant shift in U.S. tax policy, primarily targeting corporate tax rates with a historic reduction from 35% to 21%. This change, heralded by supporters as a catalyst for economic growth, aimed to stimulate investments and drive business expansion. However, the long-term effects on corporate behavior and federal tax revenue have become central to ongoing debates, particularly as its provisions begin to expire. Economic analysts and policymakers are grappling with its implications, often reflecting divergent political perspectives on fiscal responsibility and economic strategy.

Chodorow-Reich’s latest analysis in the Journal of Economic Perspectives scrutinizes the TCJA’s economic outcomes, particularly its influence on business investments and wage growth. He co-authored the study with notable economists, exploring whether the anticipated benefits, such as increased capital expenditure and higher wages, materialized as proponents hoped. The findings suggest a nuanced landscape where short-term corporate profitability surged but did not deliver the expected revenue windfall for the government, thereby prompting questions regarding the efficacy of deep corporate tax cuts.

The Impact of Corporate Tax Cuts on Business Investments

Corporate tax cuts are often justified under the premise that they incentivize businesses to invest in growth and innovation. Chodorow-Reich’s comprehensive analysis indicates that while there was an observable increase in capital investments—approximately 11% after the enactment of the TCJA—this growth came largely from specific expensing provisions rather than general rate reductions. This underscores a critical insight: targeted incentives might be more effective at stimulating economic activity than broad-based tax cuts. The challenge remains to balance these incentives with the need for sustained federal revenue.

The evidence compiled by Chodorow-Reich and his colleagues also highlights the complexity of corporate decision-making. Firms responded differently to the TCJA’s provisions, with some taking advantage of immediate write-offs for new capital. This raises fundamental questions about whether simply lowering corporate tax rates suffices for economic stimulation, or if tailored tax policies can better achieve desired economic outcomes. As Congress approaches potential reforms, understanding the implications of these findings will be crucial in shaping future tax strategies.

Evaluating Wage Growth Post-TCJA

One of the key promises of the TCJA was that corporate tax cuts would lead to significant wage increases for employees. However, Chodorow-Reich’s research indicates that the projected wage growth was overestimated. While initial expectations projected increases of $4,000 to $9,000 per full-time employee, actual data suggested a more modest rise of just $750 annually. This disparity highlights the difficulties in translating corporate profitability into tangible benefits for workers, reigniting the debate over whether corporate tax cuts effectively trickle down to employees.

The debate over wage growth also ties into broader discussions on wealth inequality and economic opportunity within the U.S. The modest gains in wages following the TCJA prompt deeper scrutiny of how tax policies impact income distribution across different socio-economic groups. As lawmakers consider reform, understanding these wage dynamics—especially in light of possible corporate revenue increases post-pandemic—will be essential in crafting equitable tax legislation that aligns with contemporary economic realities.

The Political Landscape Surrounding Corporate Tax Policy

As the expiration of several TCJA provisions approaches, the political discourse around corporate tax rates is increasingly polarized. On one hand, proponents of tax cuts argue for maintaining reduced rates to foster economic resilience, a sentiment echoed by former President Trump. Conversely, advocates for higher corporate taxes, such as Vice President Kamala Harris, argue that increased tax revenue is critical for funding social initiatives and addressing national deficits. This divide presents a complex challenge for legislators who must navigate competing economic philosophies while aiming to respond to voter concerns.

The partisan nature of the tax debate underscores the pressing need for substantive dialogue and data-driven policy evaluation. Chodorow-Reich’s research encourages policymakers to look beyond traditional narratives and consider empirical evidence regarding the efficacy of corporate tax cuts. This approach could lead to more informed decision-making that aligns with economic realities rather than political aspirations, ultimately producing a tax policy that better serves both businesses and the broader public.

Future Implications of the TCJA’s Expiring Provisions

With key provisions of the TCJA set to expire by the end of 2025, the economic implications could be significant. Lawmakers face the challenge of determining which aspects to reinstate or modify, balancing the need for corporate investment with the necessity for government revenue. As Chodorow-Reich’s findings suggest, some provisions that facilitate immediate expensing of investments have yielded better results in stimulating business growth compared to general tax cuts. Thus, as Congress prepares for negotiations, understanding the nuances of these provisions could lead to solutions benefiting both corporate interests and fiscal health.

Moreover, the potential expiration of reduced corporate rates raises questions about how such changes would impact business behavior and employment rates. Historically, firms could adjust their strategies in response to changes in corporate tax policy, potentially curtailing investments if rates rise significantly. This volatility makes it imperative for Congress to find a balanced approach that supports sustainable economic growth while ensuring adequate funding for public services and infrastructure.

Corporate Tax Rates and International Competitiveness

The global economic landscape has shifted dramatically since the passage of the TCJA, with many countries reassessing their corporate tax strategies. Chodorow-Reich’s insights indicate that the U.S., once amongst the highest corporate tax countries, now finds itself competing with nations that have lowered their rates significantly. This international pressure complicates domestic discussions about raising corporate taxes. Assessing how these global trends affect U.S. multinational corporations is critical, as many seek to optimize their tax liabilities across jurisdictions.

Understanding these dynamics offers valuable lessons for policymakers considering corporate tax reforms. Ensuring U.S. competitiveness may require a strategic mix of maintaining attractive tax rates while implementing targeted incentives that have proven effective in driving investments. As global economic competition intensifies, the U.S. must navigate these complexities to sustain its economic growth and maintain its status as a leader in innovation and business development.

Key Findings from the Journal of Economic Perspectives

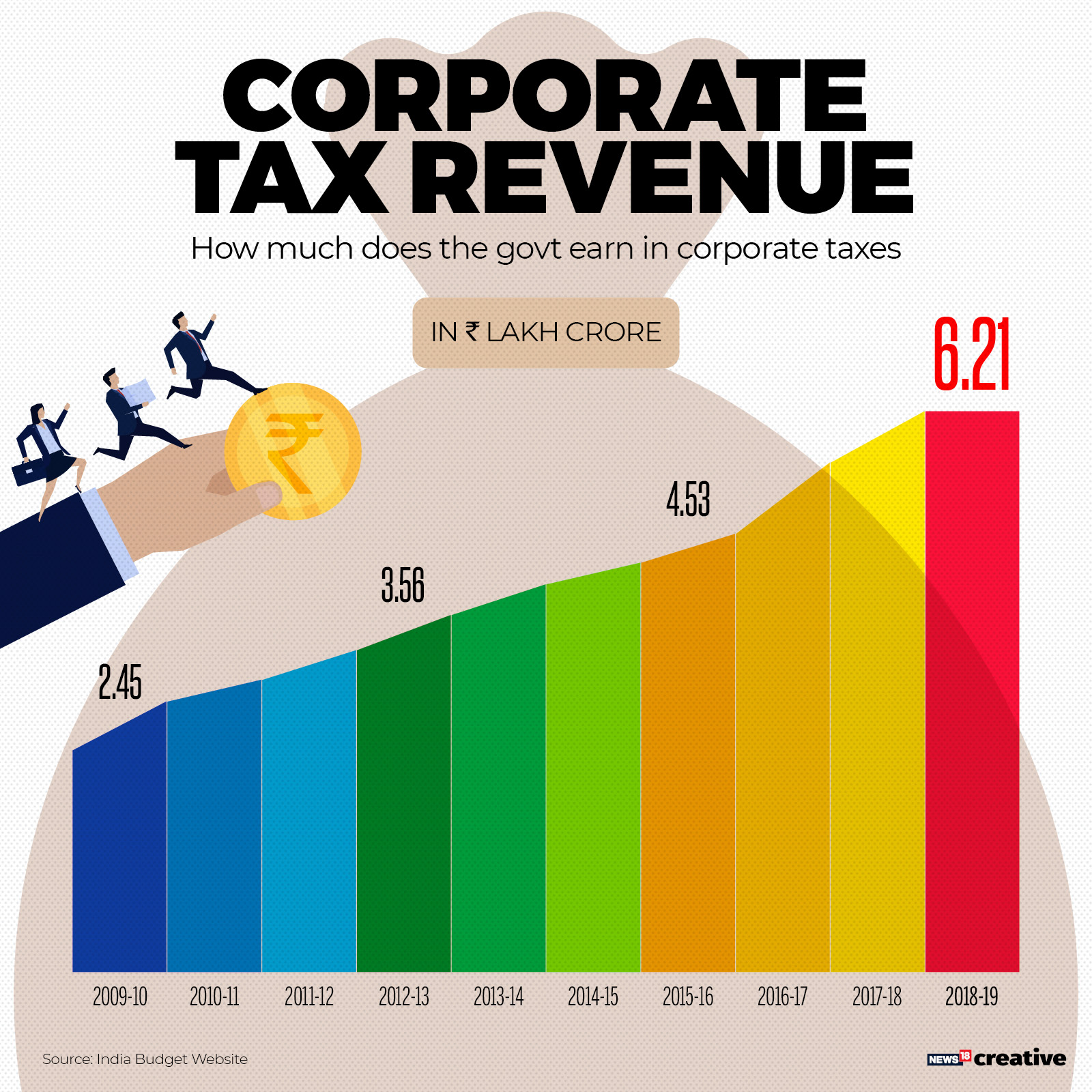

The Journal of Economic Perspectives’ recent focus on the TCJA has clarified important aspects of corporate tax policy and its implications. Chodorow-Reich and his co-authors highlight that while corporate tax cuts have led to modest increases in investments, the overall fiscal impact on government revenue has diminished substantially. With the federal corporate tax revenue initially plummeting, recovery during the pandemic underscored the need for a thorough review of tax policy effectiveness, particularly concerning long-term fiscal sustainability.

These key findings refresh the dialogue around tax policy evaluation, emphasizing the importance of empirical research in informing future legislation. As lawmakers prepare for a post-TCJA landscape, the lessons drawn from this analysis will be crucial in constructing a balanced tax framework that acknowledges both corporate needs and national fiscal responsibilities. Engaging with this data-driven approach could pave the way for nuanced tax strategies that resonate with both economic and political objectives.

Balancing Tax Revenue and Investment Incentives

The challenge of balancing tax revenue with the need for investment incentives lies at the heart of the corporate tax reform debate. Chodorow-Reich’s analysis suggests that instead of relying solely on broad-based corporate tax cuts, policymakers might achieve better outcomes through targeted tax incentives that specifically stimulate new investments. This nuanced approach could lead to more sustainable economic growth while addressing the pressing need for government revenue.

As Congress contemplates potential reforms for the upcoming fiscal year, the insights from recent economic analyses must guide these discussions. Crafting a corporate tax structure that effectively funds essential public services while fostering a robust investment climate will be critical in mitigating long-standing economic disparities. Addressing these dual objectives requires innovative thinking and collaboration across political lines to develop a tax policy that is both effective and equitable.

Addressing Public Concerns Over Tax Policy

Public sentiment concerning tax policy remains a pivotal factor as voters approach the 2024 elections. Many citizens express concerns about the fairness and effectiveness of corporate tax cuts, particularly in the context of rising income inequality. Economists like Chodorow-Reich argue that a deep understanding of tax policy’s impacts on income distribution is vital for addressing these concerns. Engaging the public with clear communication about how tax reforms can drive economic benefits for all is critical for restoring trust in governmental decision-making.

Further complicating this landscape is the varied perception of tax cuts’ benefits among different income groups. High-income earners might favor corporate tax reductions, believing they enhance investment opportunities. In contrast, lower-income households might prioritize the restoration of social safety nets potentially funded by increased corporate tax revenues. Moving forward, transparency in tax policy discussions and a commitment to incorporating diverse stakeholder voices will be essential to ensure that fiscal reforms resonate positively with the electorate.

Frequently Asked Questions

What were the key provisions of the 2017 Tax Cuts and Jobs Act regarding corporate tax rates?

The 2017 Tax Cuts and Jobs Act (TCJA) significantly reduced the corporate statutory tax rate from 35% to 21%, which aimed to stimulate economic growth by encouraging business investment. Moreover, it included provisions for immediate expensing of capital investments and research expenditures, incentivizing firms to invest in growth.

How did the economic impact of tax cuts in the TCJA affect business investments?

The economic impact of corporate tax cuts under the TCJA was notable, with an estimated 11% increase in capital investments. This was particularly driven by expiring provisions that allowed firms to write off expenses immediately, proving more effective than mere tax rate reductions in promoting investment.

What does the Chodorow-Reich analysis reveal about the relationship between corporate tax rates and wage growth?

The Chodorow-Reich analysis suggests that while corporate tax cuts under the TCJA were intended to raise wages, the actual increase was modest, estimated at around $750 annually per full-time employee, significantly lower than earlier predictions of $4,000 to $9,000. This indicates that while tax policy influences corporate behavior, the effects on wage growth may not meet optimistic expectations.

Why do some economists advocate for raising corporate tax rates despite the TCJA’s cuts?

Some economists argue for raising corporate tax rates because they believe previous reductions have not led to significant benefits for workers or substantial increases in federal revenue. They contend that the declining tax revenue alongside modest wage growth post-TCJA suggests the need for reevaluation of corporate tax policy to ensure a more equitable economic impact.

What were the longer-term effects on federal corporate tax revenue following the TCJA?

Initially, federal corporate tax revenue dropped by 40% after the TCJA’s enactment; however, it rebounded by 2020 as business profits surged. The increase in corporate tax revenues perplexed many, prompting further investigation into the reasons behind heightened profits during the pandemic, including changes in accounting practices and shifts in global tax strategies.

| Key Points |

|---|

| The 2017 Tax Cuts and Jobs Act (TCJA) reduced corporate tax rates from 35% to 21%. This was a significant tax reform after over 30 years. |

| The law aimed to boost economic growth through corporate tax cuts, but the actual benefits in terms of wage increases were modest. |

| A study indicated that while capital investments increased by about 11%, the overall decline in federal corporate tax revenue was significant. |

| The TCJA included provisions allowing immediate write-offs of new investments, which proved to be more effective than simple rate cuts. |

| Corporate tax revenue plummeted by 40% initially but surged during the pandemic as business profits increased unexpectedly. |

| The upcoming Congressional battle in 2025 will address the expiration of key TCJA provisions, including corporate tax cuts. |

Summary

Corporate tax cuts remain a contentious issue as Congress prepares for a critical tax battle in 2025. The analysis of the 2017 Tax Cuts and Jobs Act reveals mixed results, prompting debates over its effectiveness in stimulating economic growth and generating revenue. While some provisions led to modest increases in investment, the overall impact on wages was less dramatic than anticipated. As the expiration of these cuts looms, policymakers must carefully evaluate the balance between fostering growth and maintaining tax revenue.