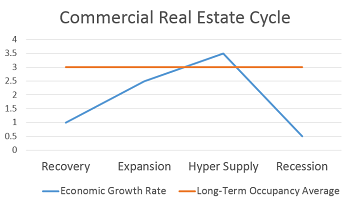

In today’s dynamic financial landscape, the commercial real estate economy faces unprecedented challenges that could reshape its future. High office vacancy rates, exacerbated by shifts in work culture, have left many investors on edge, fearing for their assets and the broader financial system. As commercial mortgage debt reaches critical levels, experts warn of potential risks posed by rising interest rates and the looming implications of a bank financial crisis. The interplay between these factors hangs heavy in the air, creating real estate investment challenges that require immediate attention and strategic foresight. Understanding how these elements intertwine is vital for investors and stakeholders alike as they navigate this evolving market and its repercussions on the economy.

The realm of commercial property investment is undergoing a significant transformation, with looming questions regarding its stability in the post-pandemic era. Declining demand for business spaces has led to increased vacancy rates, which combined with mounting commercial loan obligations, poses a serious threat to financial institutions. Rising borrowing costs are further complicating the landscape, raising concerns about the resilience of lenders as they manage the fallout of a potential financial strain. As the market grapples with these pressing issues, clarity around the consequences for the wider economic environment becomes crucial. It is imperative for commercial property stakeholders to adapt to the shifting paradigm to ensure sustainable growth in this fluctuating marketplace.

The State of Commercial Real Estate: An Overview

The commercial real estate landscape has faced significant challenges in recent years, particularly due to the COVID-19 pandemic’s impact on office building occupancy. With vacancy rates soaring in major cities, averaging between 12% to 23%, the consequences for local economies are profound. This decline in demand has led to a decrease in property values, further complicating the financial health of investors and banks that hold substantial real estate loans.

Moreover, the looming deadlines for commercial mortgage debt maturity—20% of the $4.7 trillion held by lenders and investors due this year—add to the precarious situation. While some segments, like super-premium office spaces with enhanced amenities, are resilient, the broader market is grappling with over-leveraged properties and shifting demand. Investors face tough decisions as they navigate a landscape still plagued by high interest rates and potential economic downturns.

Impact of High Office Vacancy Rates on the Economy

High office vacancy rates are not merely a statistic; they can herald significant economic repercussions, particularly for local businesses and financial institutions. When office spaces sit empty, property owners struggle with loss of income, leading to difficulty in covering operational costs, mortgage payments, and taxes. This squeeze can result in reduced spending within the community, hitting retail sectors and services that depend on foot traffic and occupancy in commercial spaces.

In addition, regional banks heavily invested in commercial real estate may face increased delinquency rates on loans tied to these upsurging vacancies. As the value of collateralized properties declines, the risk of defaults increases, which can threaten the stability of these institutions and, subsequently, the wider economy. Overall, while some sectors may thrive, the ramifications of a sluggish commercial real estate market can percolate through the financial system, affecting consumer confidence and spending.

The Role of Interest Rates in Real Estate Valuation

Interest rates play a crucial role in determining the valuation and viability of commercial real estate investments. With the Federal Reserve hesitating to lower rates amidst concerns over inflation, many investors are grappling with higher borrowing costs that significantly impact their bottom lines. Increased interest rates lead to higher mortgage payments for borrowers, which in turn can depress property values and make refinancing difficult.

Additionally, the persistence of elevated interest rates raises concerns about the potential for a downturn in real estate investments overall. Investors once accustomed to low rates may find themselves unable to sustain existing debts, particularly as a significant portion of commercial mortgage debt comes due this year. This precarious situation necessitates strategic planning and careful consideration of financing options to mitigate potential financial distress.

Regional Banks and Commercial Mortgage Debt

Regional banks, which often have a higher concentration of commercial mortgage loans compared to their larger counterparts, find themselves in a challenging position as office vacancy rates remain elevated. As delinquency rates rise, the financial health of these institutions could be severely tested. The consequences could extend beyond just banking, as these regional lenders play a significant role in the local economy, funding everything from small businesses to residential projects.

The implications of a wave of bad commercial mortgage debt are significant. If regional banks suffer substantial losses, there may be a tightening of lending practices, adversely affecting businesses and consumers reliant on credit. Such a scenario could lead to reduced economic activity in affected regions, amplifying the overall challenges faced within the commercial real estate market.

Forecasting the Future of Commercial Real Estate Investments

As investors gaze into the future of commercial real estate investments, the landscape remains fraught with uncertainty. The transition back to remote and hybrid work arrangements has resulted in persistent office vacancies, while rising interest rates challenge the financial feasibility of many investment strategies. With a significant portion of commercial mortgage debt coming due soon, stakeholders must brace for potential shifts in the market.

The key for many real estate investors will be to identify sectors likely to withstand the storm, such as logistics and industrial spaces that have flourished during the e-commerce boom. Adaptability will also be crucial—converting unused spaces for new ventures or repurposing them to meet evolving consumer needs could present viable paths forward. However, navigating these changes will require careful analysis and an understanding of market dynamics.

The Economic Consequences of Rising Delinquencies

A rise in delinquencies among commercial real estate loans could have ripple effects throughout the U.S. economy. For instance, if multiple investors default on their loans, regional banks that financed these properties may face increased pressure, forcing them to tighten credit availability. This contraction in lending can inhibit business expansion and consumer spending, leading to a broader economic slowdown.

Furthermore, investors’ losses will likely affect investment returns for pension funds and insurance companies that are significant holders of real estate assets. As these entities adjust their portfolios in response to market volatility, consumer financial stability may erode, creating a feedback loop that exacerbates economic challenges. Ultimately, managing these risks proactively will be vital to maintaining overall economic health.

Mitigating Risks in Commercial Real Estate Investments

Addressing the risks associated with commercial real estate investments is imperative for long-term financial stability. Investors must recalibrate their strategies based on current realities, employing rigorous financial analyses and stress testing scenarios to prepare for potential market downturns. Diversification can also play a key role in mitigating the impact of widespread delinquencies.

Moreover, understanding regulatory frameworks and keeping abreast of economic indicators will enhance decision-making. Partnerships with local governments to repurpose vacant properties for community needs can give investors alternative pathways, contributing positively to the local economy and potentially leading to new revenue streams.

The Evolution of Office Space Demand Post-Pandemic

As businesses adapt to the post-pandemic world, the demand for office space is undergoing a transformation. Many companies are embracing hybrid work models, leading to a steady decline in the need for traditional office configurations. This shift presents both challenges and opportunities for real estate investors who must adjust their strategies to align with changing tenant preferences.

Moreover, this evolution highlights the importance of flexibility in office design, as businesses seek spaces that can accommodate diverse needs, from collaborative areas to quiet zones. Investors looking to engage with the market should consider how property features can drive tenant retention and attract new leases, particularly in a competitive landscape where adaptability will likely define success.

Banking Industry Preparedness Amidst Commercial Real Estate Concerns

The intensity of challenges facing the banking industry regarding commercial real estate varies significantly between large and regional banks. While major banks like Bank of America and JPMorgan Chase have diversified portfolios and stringent regulatory frameworks, regional banks often have a higher concentration of commercial mortgage debt—and subsequently, risk. This disparity could lead to different outcomes during economic strain.

Large banks, having weathered previous financial crises, are more equipped to absorb shocks and continue functioning smoothly, while smaller banks may struggle if faced with high levels of delinquent loans. Institutional resilience is essential in maintaining confidence in the financial system—an essential factor for broader economic health as commercial real estate turmoil unfolds.

Navigating the Future of Commercial Real Estate Financing

As the commercial real estate market faces uncertainty, navigating financing options becomes crucial for investors and property owners. With interest rates fluctuating and a significant volume of mortgage debt due, stakeholders must adopt strategic approaches—like refining investor profiles and seeking alternative financing. Innovative funding solutions may emerge to meet evolving market needs.

Exploring non-traditional financing sources, such as crowdfunding or investment from private equity firms, could provide alternative avenues for capital without exacerbating debt burdens. By leveraging technology and networking, investors can gain access to new funding mechanisms that align with current market realities, potentially ensuring financial viability in a shifting landscape.

Frequently Asked Questions

How do high office vacancy rates impact the commercial real estate economy?

High office vacancy rates can significantly depress property values, leading to lower returns for investors in the commercial real estate economy. When vacancy rates rise, particularly post-pandemic, it indicates decreased demand for office space, which can result in lower rental income and profits for property owners. As values drop, it affects the overall stability of the commercial real estate market, potentially leading to increased delinquencies on commercial mortgage debt.

What role do interest rates play in the commercial real estate economy?

Interest rates are a key factor influencing the commercial real estate economy as they directly impact borrowing costs for property investors. When interest rates rise, it increases the cost of commercial mortgage debt, making it more expensive for investors to finance properties. This can lead to higher vacancy rates and lower property values, subsequently affecting the financial health of banks and the overall economy.

What challenges does the commercial real estate economy face due to the potential bank financial crisis?

The commercial real estate economy is facing significant challenges due to the looming bank financial crisis as many regional banks hold extensive commercial mortgage debt. If a wave of delinquencies occurs due to rising interest rates and high vacancy rates, it could destabilize these banks, leading to tighter lending conditions and decreased investment in commercial properties, further exacerbating the challenges in the market.

How are commercial mortgage debts affecting the outlook of the commercial real estate economy?

Commercial mortgage debts are creating a challenging outlook for the commercial real estate economy, as nearly 20% of the $4.7 trillion in commercial mortgage debt is due this year. With many investors facing the risk of significant losses, this could lead to a wave of bankruptcies in the sector, impacting investor confidence and further lowering property values.

What can be done to mitigate the real estate investment challenges in the commercial real estate economy?

To mitigate real estate investment challenges in the commercial real estate economy, lowering long-term interest rates would be beneficial, allowing for easier refinancing of debts. Additionally, strategic modifications such as converting vacant office buildings into residential spaces could help revitalize underperforming assets, but this faces numerous zoning and engineering obstacles.

Why is the potential for increased office vacancy rates concerning for the U.S. economy?

Increased office vacancy rates are concerning for the U.S. economy as they signal reduced demand for office space, which can lead to depreciating property values and financial strain on regional banks. This can result in less capital flowing into the economy due to tighter lending practices, ultimately affecting consumer spending and economic growth.

How does the health of large banks impact the commercial real estate economy?

The health of large banks is crucial for the commercial real estate economy because they are better capitalized and more diversified than smaller banks. If large banks like JPMorgan Chase or Bank of America manage to withstand losses from commercial mortgage debt, they can continue to provide necessary funding to the commercial real estate sector, which helps stabilize the economy.

What can we expect in the commercial real estate economy if interest rates remain high?

If interest rates remain high, we can expect continued challenges in the commercial real estate economy, including prolonged high office vacancy rates, reduced investment, and potential insolvencies among investors. This environment would likely further dampen property values and could lead to increased delinquencies on commercial mortgage debt, impacting the broader financial system.

| Key Points | |

|---|---|

| High office vacancy rates range from 12% to 23% in major U.S. cities. | Demand has dropped significantly since the pandemic, influencing property values negatively. |

| 20% of $4.7 trillion in commercial mortgage debt comes due this year. | A significant portion of lenders’ assets are tied to commercial real estate loans. |

| While some bank failures may occur, a full financial crisis is not anticipated, according to experts like Kenneth Rogoff. | Some banks, particularly smaller ones, may face more significant challenges due to looser regulations. |

| The fallout from real estate losses may impact consumers through lower consumption and tougher lending. | Large banks are more diversified and better positioned to absorb potential losses from real estate debt. |

Summary

The commercial real estate economy is currently facing significant challenges, primarily due to high office vacancy rates exacerbated by the pandemic. As demand for downtown office spaces plummets, property values are depressed, creating a ripple effect that could impact banks and investors alike. While some regional banks may experience difficulties due to their exposure to commercial real estate, experts believe that the formidable structure of major banks will help to avert a financial crisis on the scale witnessed in 2008. Furthermore, while consumers may feel some strain from localized bank failures, the broader economy remains resilient with a solid job market and booming stock prices. Stakeholders in the commercial real estate sector are advised to remain cautious and prepare for a prolonged adjustment period ahead.