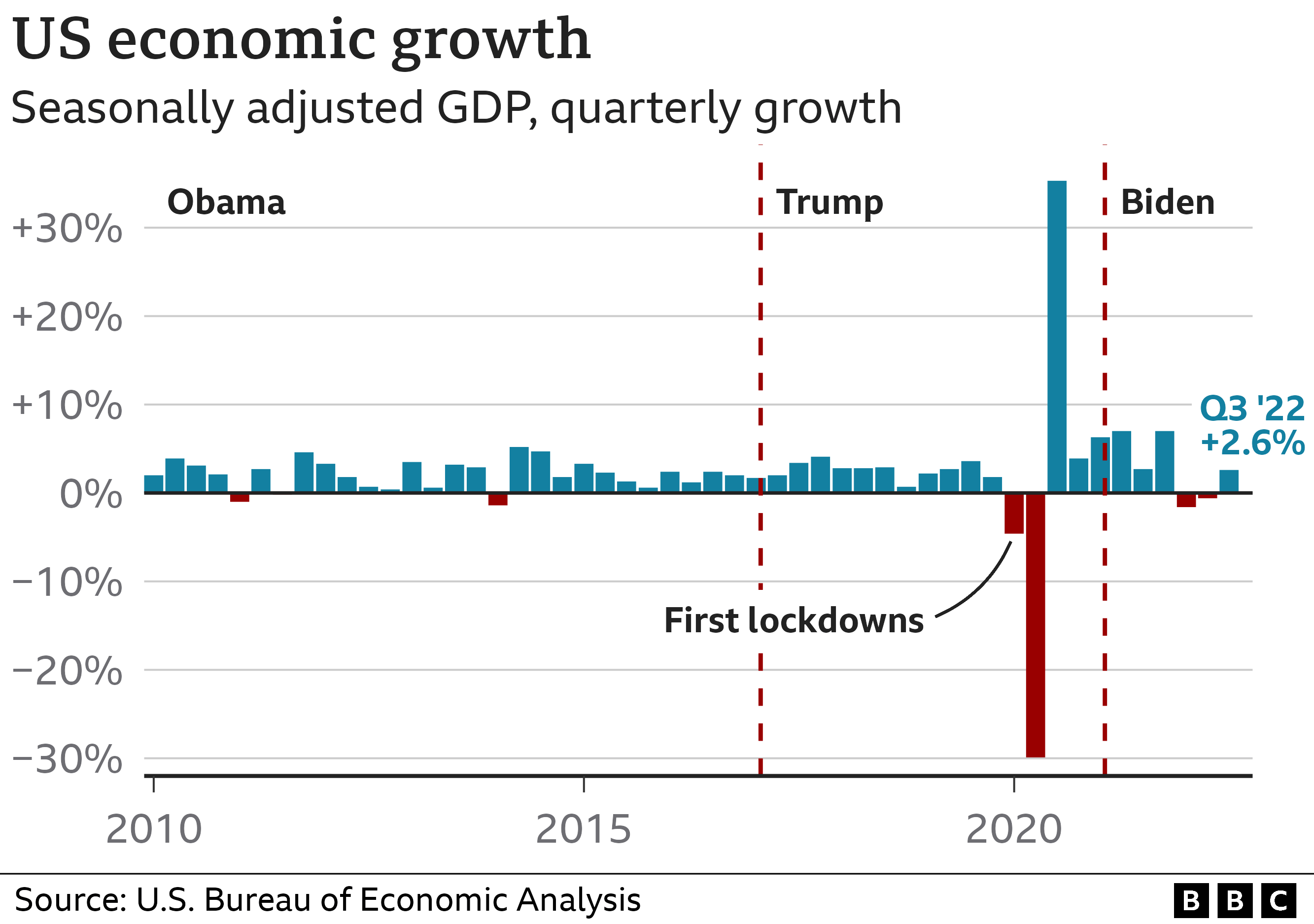

The U.S. economy is currently at a critical crossroads, grappling with significant challenges that have emerged in recent months. As the threat of recession risk looms large, many analysts are concerned about the impact of ongoing trade wars and their potential to destabilize markets. Recent stock market crashes have raised alarms among investors, prompting closer scrutiny of the Federal Reserve and its interest rate policies. Compounding these concerns, the consumer sentiment index has plummeted, reflecting waning confidence among American households. With these factors in play, understanding the intricate interplay of economic forces becomes crucial for navigating the path ahead.

Currently, the American economic landscape faces considerable scrutiny, marked by escalating tensions and uncertainty. With the threat of an economic downturn looming, discussions of trade disputes are becoming increasingly relevant, raising questions about their lasting influence on domestic markets. Market instability has left many wondering about the sustainability of recent gains, especially following recent declines in stock performance. Furthermore, widespread anxieties surrounding the Federal Reserve’s interest rate adjustments are heightening the stakes in an already volatile environment. As consumer confidence dips, it becomes essential to explore the implications of these developments for the future of the nation’s financial health.

Understanding the U.S. Economy: Current Challenges

The current state of the U.S. economy reflects a complex interplay of various factors that pose significant challenges. Rising tensions from ongoing trade wars, particularly exacerbated by tariffs imposed on goods from China, Mexico, and Canada, have heightened fears of a downturn. Analysts point to the possibility of a recession as a credible outcome in the near future, driven by these tariffs that disrupt trade relationships and strain consumer confidence. The University of Michigan’s consumer sentiment index, which has recently dipped to its lowest level since November 2022, highlights the growing uncertainty among consumers who influence economic activity strongly.

Moreover, as we navigate this economic volatility, the stock market has also experienced notable fluctuations, with significant sell-offs affecting major indices. Investors are increasingly worried about the potential for a stock market crash, which often serves as a forewarning of broader economic troubles. The interaction between consumer sentiment, stock performance, and trade policy creates a precarious environment that demands scrutiny and adaptive policy measures from both economic analysts and policymakers alike.

Impact of Trade Wars on Economic Stability

Trade wars can have far-reaching implications for economic stability, and the current tariffs imposed on American goods are no exception. Tariffs initially intended to protect domestic industries often lead to retaliatory measures from trading partners, causing a cycle of escalation that harms economic relationships. This environment of increased unpredictability has been cited as a significant contributor to the declining consumer sentiment index, making households wary of spending and investment, which are critical for economic growth.

Disruptions caused by these trade wars not only threaten immediate financial prospects but can also destabilize long-term economic strategies. As companies adjust to the new realities of higher tariffs, they may slash jobs or reduce investment in innovation. The result can be a slowdown that potentially sends the economy spiraling towards recession, particularly if consumer spending continues to dwindle in light of heightened anxiety about future economic activity.

The Role of the Federal Reserve in Navigating Economic Uncertainty

In times of economic uncertainty, the Federal Reserve faces tough decisions that impact the wider economy. The dual mandate of promoting maximum employment and maintaining stable prices creates a challenging balancing act, especially amidst rising inflation and potential recession indicators. As recent assessments have suggested, the Fed’s handling of interest rates becomes critical; maintaining rates too high could stifle growth, while cutting them too soon might exacerbate inflationary pressures.

With the trade war and its associated disruptions acting as adverse supply shocks, the Fed’s response must be carefully calibrated. A reduction in interest rates may provide a much-needed stimulus to support employment but risks igniting inflation, complicating policy strategies as stakeholders in the financial sector and the public closely watch the central bank’s every move. The current predicament underscores the importance of adaptive and responsive monetary policy in guiding recovery and stability.

Current Consumer Sentiment and Its Economic Implications

The University of Michigan’s consumer sentiment index shows a striking decline, indicating a level of public anxiety surrounding economic conditions not seen in recent years. This sentiment is crucial, as consumer spending drives a significant portion of the U.S. economy. Fear of a recession may lead households to curtail spending, impacting businesses and potentially triggering a cumulative economic downturn.

Moreover, the implications of declining consumer confidence extend beyond immediate spending patterns. When consumers perceive increased risks—whether due to unstable government policies, tariffs, or fluctuating market conditions—they may choose to delay significant purchases or investments. This behavior can create a feedback loop, leading to lower business revenues and potentially forcing companies to reconsider their hiring practices, further exacerbating economic challenges.

Risk Perception and Its Effect on Investment Decisions

Heightened risk perception plays a crucial role in shaping investment decisions within the economy. As uncertainty surrounding tariff policies and trade relationships increases, companies may find it difficult to proceed with long-term investments. This pause in investment not only stifles growth in various sectors but contributes to a broader economic malaise. Investors are particularly sensitive to changes in risk perception, which influences their appetite for taking on potential losses in a volatile market.

In light of the current conditions, businesses may adopt a ‘wait and see’ approach, leading to stagnation in sectors that rely heavily on capital investment. The uncertainty surrounding government spending and potential fiscal crises only adds to this pervasive risk landscape. For the economy to rebound, clarity and stability in policy direction are necessary to restore investor confidence and stimulate growth.

Federal Reserve Interest Rates: The Balancing Act

The Federal Reserve’s management of interest rates is a critical component of its economic strategy, especially during turbulent times. As the economy faces challenges such as the repercussions of trade wars and a fluctuating stock market, the Fed must consider whether to cut rates to promote growth or maintain them to control inflation. This juggling act is compounded by the current economic climate, where the perception of risk looms large and influences investor behavior.

Recent discussions within the Fed voice concerns about the misalignment of policy with economic realities, as higher interest rates could potentially aggravate the challenges faced by consumers and businesses alike. Conversely, cutting rates suppresses inflation concerns but may also fail to address underlying weaknesses in the economy. The Fed’s response must therefore be both strategic and attuned to the evolving economic landscape, seeking not only to promote recovery but to ensure long-term stability.

The Dangers of Prolonged Economic Uncertainty

Prolonged economic uncertainty can have profound implications, leading to reduced investment, job cuts, and, ultimately, a contraction of the economy. As seen in the current landscape, continuous shifts in trade policy and government spending practices create an environment of unpredictability that pushes households and businesses to adopt more cautious behaviors. Such uncertainty can erode consumer confidence, further exacerbating economic woes.

This cycle of anxiety discourages spending and investment, creating a feedback loop that can be tough to break. Should the economic uncertainty persist, the risk of entering a recession becomes significantly heightened, as sustained drops in hiring and consumption can lead to broader economic malaise, challenging recovery efforts. This highlights the need for clear, consistent communication and policies that mitigate uncertainty to bolster economic resilience.

Indicators of a Potential Recession

Several indicators suggest that the U.S. economy may be teetering on the brink of a recession. The combination of a falling consumer sentiment index and reduced hiring are signs that not only reflect current economic anxiety but also signal potential future downturns. Analysts express concern that if these trends continue, the economy could enter a recessionary phase that reverberates throughout various sectors.

Addressing these indicators requires proactive measures from policymakers, especially in navigating the complexities introduced by tariffs and recent market volatility. Monitoring these signals closely will be essential as stakeholders consider potential interventions aimed at stabilizing the economy and restoring confidence among consumers and investors alike.

Strategies for Economic Recovery

In light of the current economic landscape facing the U.S. economy, strategic initiatives are crucial for fostering recovery and stability. Policymakers need to focus on restoring confidence among consumers and businesses by implementing measures that clarify the direction of trade and fiscal policies. Through transparent communication and commitment to sound economic policies, it is possible to mitigate some of the adverse effects stemming from recent uncertainties.

Investment in infrastructure, job creation programs, and innovation can help spur economic growth and offset some of the damage inflicted by trade wars and declining consumer confidence. By promoting a stable economic environment and reducing perceptions of risk, these strategies could ultimately lead to a resurgence in economic activity, paving the way toward a more robust and resilient U.S. economy.

Frequently Asked Questions

What is the current recession risk in the U.S. economy?

The recession risk in the U.S. economy has become more pronounced due to rising concerns over trade wars and stock market instability. As consumer sentiment indexes show lower confidence levels, economists are more worried about a potential recession occurring within the next year.

How does the trade war impact the U.S. economy?

The trade war is significantly impacting the U.S. economy by causing uncertainty among investors and businesses. Tariffs imposed on American goods by countries like China and Mexico could lead to a slowdown in trade and economic growth, potentially increasing the risk of a recession.

What should investors know about stock market crashes and the U.S. economy?

Investors should recognize that stock market crashes can signal deeper issues within the U.S. economy, especially amidst high recession risks. Declining stock prices often reflect reduced confidence in economic stability, which can lead to decreased investment and consumption.

How are Federal Reserve interest rates influencing the U.S. economy?

Federal Reserve interest rates play a crucial role in influencing the U.S. economy. During uncertain times, the Fed faces a dilemma: lowering interest rates can support economic growth, but may also fuel inflation. As the trade war and market conditions evolve, the Fed must carefully consider its next steps.

What does the consumer sentiment index indicate about the U.S. economy’s future?

The University of Michigan’s consumer sentiment index indicates a drop in consumer confidence, which historically correlates with economic downturns. A declining sentiment may signal that consumers are more cautious about spending, potentially leading to a slowdown in the U.S. economic growth.

| Key Issue | Details |

|---|---|

| Trade War Impact | Heavy losses in U.S. markets due to tariffs imposed by China, Mexico, and Canada, leading to recession fears. |

| Consumer Sentiment | The University of Michigan’s consumer sentiment index has dropped to the lowest levels since November 2022. |

| Tariff Policy Criticism | Economists argue that tariffs are detrimental and do not necessarily lead to long-term economic growth. |

| Possible Recession Signals | Key indicators suggest recession risks: trade war, stock market crash, government spending cuts, and increased risk perception. |

| Federal Reserve Dilemma | The Fed faces a tough decision between cutting interest rates to stimulate the economy or keeping them steady to combat inflation. |

Summary

The U.S. economy is currently navigating through turbulent conditions marked by trade tensions and declining consumer confidence. As significant challenges loom, including government spending cuts and erratic tariff policies, there is heightened concern over a potential recession. The economy’s resilience is being tested, and policymakers must strike a careful balance to stabilize growth while addressing inflationary pressures.