Trump Fed Chairman Jerome Powell has found himself at the center of a contentious relationship between the White House and the Federal Reserve, as President Trump has often voiced his dissatisfaction with Powell’s approach to monetary policy. Since Powell’s initial nomination in 2017, the ongoing debates about interest rates and economic policy have sparked significant market reactions, raising concerns over the Fed’s independence. Trump’s criticism pivots around Powell’s perceived hesitance to aggressively lower interest rates, which the president believes is essential for invigorating the economy. This push-and-pull dynamic underscores the complexities of economic governance in the U.S. and its implications on the broader financial landscape. The delicate dance between political influence and monetary policy continues to engage analysts and market observers alike, as they assess the potential consequences of any drastic decisions regarding the Fed’s leadership.

The ongoing tensions over the leadership at the helm of the nation’s central bank highlight a broader conversation about independence in economic governance. The chair of the Federal Reserve faces scrutiny as differing perspectives on monetary management emerge, particularly in relation to interest rate adjustments and overall economic strategy. Trump’s administration posits that a more aggressive stance on cutting rates is necessary for economic stimulation, reflecting a viewpoint that aligns with short-term growth goals. Conversely, Powell and his adherents advocate for cautious monetary policy to maintain stability and address inflation concerns. This discourse illustrates the fundamental challenges of balancing political pressures with the Fed’s vital role in shaping economic outcomes.

Can President Trump Fire the Fed Chairman?

The question of whether President Trump can fire Federal Reserve Chairman Jerome Powell is rooted in complex legal interpretations. The Federal Reserve Act of 1913 allows for governors to be removed for cause, yet it is unclear if this applies to the chair. The intricacies of U.S. law mean that there is a debate over whether Powell, appointed by Trump in 2017, has the same protection as other board members. Some legal scholars suggest that the changes made to the Act in the 1970s may not extend the ‘for cause’ protections to the chair, complicating the question of removal. Furthermore, the legal ramifications of such a move could jeopardize the Federal Reserve’s independence, which is vital for maintaining market stability and investor confidence.

Market responses to the potential firing of Powell would be significant, with many analysts predicting a jolt throughout financial sectors. The Fed’s influence in regulating interest rates and shaping monetary policy means that any perceived instability, such as a change in leadership, would likely trigger fluctuations in stock and bond markets. President Trump has indicated that he had no plans to fire Powell, possibly recognizing the backlash that could ensue from a politically motivated removal. Moreover, as the independence of the Fed is crucial for public trust, any attempts to oust Powell would likely be viewed as an encroachment on a vital institutional foundation that underpins economic stability.

Additionally, political dynamics play a crucial role in this discussion. The relationship between Trump and Powell has been contentious, particularly concerning monetary policy decisions and interest rate adjustments. Trump’s advocacy for lower rates to spur economic growth contrasts with Powell’s more cautious monetary policy stance, which aims to control inflation and promote long-term stability. Such disagreements not only highlight differing economic philosophies but also bring into question how the market reacts to political maneuvers regarding Fed leadership. Trump’s threat to oust Powell could be interpreted as an effort to reassert control over monetary policy to align it with his economic agenda.

The Implications of Firing the Fed Chairman

Firing the Fed Chairman, especially someone like Jerome Powell, would have extensive implications both legally and economically. A significant concern among analysts is the impact on the Federal Reserve’s credibility. The Fed is expected to act independently of political pressures, making decisions based on economic data rather than the preferences of the administration. If Powell were to be removed, it could undermine that credibility and raise fears of politically influenced monetary policy, which in turn could lead to higher inflation and economic uncertainty. Market participants often react adversely to instability within the Fed, fearing that changes in leadership may prompt sharp shifts in interest rates and monetary policy, ultimately affecting investments and borrowing costs across the economy.

Moreover, the long-term consequences of such a firing could extend beyond immediate market reactions. A loss of independence for the Federal Reserve could pave the way for future administrations to exert similar strategies, jeopardizing the central bank’s ability to function optimally. This scenario raises significant questions about the balance of power between the executive branch and independent regulatory bodies. Should the Fed’s independence be compromised, it could lead to a paradigm shift in how monetary policy is conducted in the United States, possibly causing a fracturing of the established credit system that markets rely upon.

Additionally, it is pertinent to consider the legal landscape surrounding such a move. Recent U.S. Supreme Court cases indicate a trend toward increasing executive authority, but they may not extend to removing heads of independent agencies like the Fed without substantial justification. Legal experts express that even if President Trump pursued this course, any action could be faced with immediate scrutiny and potential judicial challenges, further unsettling already jittery markets. The debate surrounding these issues underscores the necessity for finding a balance between political influences and the essential autonomy that agencies like the Federal Reserve must maintain to navigate economic challenges effectively.

Understanding the Federal Reserve’s Independence

The independence of the Federal Reserve is crucial for effective monetary policy. This independence allows the Fed to make difficult, sometimes unpopular, decisions based on economic data without the immediate pressure of political considerations. The Fed’s primary mandate includes managing inflation and maximizing employment, which requires a level of discretion and resilience against political whims. In times of economic crisis, such independence often enables central banks to respond promptly and effectively to stabilize the economy. An environment where the Fed operates uninfluenced by the current political climate fosters public confidence that monetary policy decisions stem from professional economic judgments rather than political calculations.

Yet, the story of the Fed’s independence is not without its complexities. Historical instances where political pressure has influenced Federal Reserve decisions provide insight into how fragile this balance can be. U.S. administrations have sometimes sought to sway the Fed’s actions, particularly during election cycles or economic downturns, seeking quick fixes to lingering economic issues. The Fed’s ability to resist such pressures is paramount, not only for the institution’s credibility but also for broader economic health. If the tradition of independence were to be undermined through executive actions, the implications could lead to a loss of trust from both domestic and international investors, destabilizing markets and potentially leading to economic downturns.

The economic landscape is undeniably affected when the independence of the Federal Reserve is questioned. For instance, markets react negatively to perceived threats against the Fed’s autonomy, fearing that political motivations might lead to inflationary pressures should interest rates be manipulated for political gain. This scenario emphasizes the importance of maintaining a clear separation between the Fed’s monetary policy experts and political influences. By ensuring that monetary policy decisions are insulated from political machinations, the Fed can strive to keep inflation near its target and avoid erratic swings in the economy that may arise from short-term political pressures.

Market Reactions to Potential Changes in the Fed Leadership

Market reactions to potential changes in leadership at the Federal Reserve are critical indicators of investor confidence and economic outlook. Any hint that Jerome Powell’s role as Fed Chairman is in jeopardy could lead to immediate volatility in stock and bond markets. Investors closely monitor the Fed’s decisions on monetary policy, including interest rate hikes or cuts, as these directly impact borrowing costs and the overall economic environment. A sudden shift in leadership could, therefore, unsettle markets, as uncertainty about future policies can lead to increased volatility and risk aversion among investors.

Additionally, the fear of a more accommodative monetary policy arising from a new appointee could provoke significant market reactions due to anticipation of rising inflation rates. Capital markets thrive on predictability, and any disruption in the leadership of an institution like the Federal Reserve could provoke panic selling or, conversely, speculative buying if investors believe that a new chair could pursue more aggressive policies. This highlights why political discussions surrounding the Fed’s leadership have profound implications for economic stability and market reactions.

Beyond immediate market responses, the removal of a respected figure like Powell might have long-lasting implications for investor sentiment and fiscal policy perceptions. For instance, if the market perceives a move toward looser monetary policies as a means to placate political agendas, trust in the Fed’s ability to control inflation and maintain stability may diminish. This perceived lack of independence could lead investors to demand higher yields on bonds, fearing increased inflation down the line. Therefore, the markets are likely to reflect their concerns through price adjustments, illustrating how deeply intertwined market stability is with the perceptions of Federal Reserve leadership.

The Role of Jerome Powell in Current Economic Policy

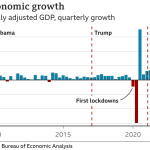

Jerome Powell, as the current Chair of the Federal Reserve, holds a pivotal role in shaping U.S. economic policy during challenging times. His decisions on interest rates and monetary policy significantly influence everything from inflation rates to employment statistics. Under Powell’s leadership, the Fed has navigated numerous economic challenges, including the aftermath of the COVID-19 pandemic, which required a delicate balance between encouraging growth and keeping inflation in check. Powell’s approach has often been characterized by a focus on gradual adjustments in monetary policy, emphasizing the need to monitor economic indicators closely while avoiding abrupt shifts that could destabilize markets.

Moreover, Powell’s ability to communicate effectively with both the public and markets plays a significant role in shaping economic expectations. He has worked to build confidence in the Fed’s commitment to its dual mandate of price stability and full employment, while also addressing the evolving challenges within the global economy. Powell’s past experiences and educational background lend him credibility as a leader who can navigate the complexities of the role, and his position often serves as a barometer of investor trust in the Federal Reserve’s functions.

However, Powell’s relationship with President Trump has been fraught with tension, particularly around issues concerning monetary policy. Trump’s calls for aggressive rate cuts to stimulate the economy contrasted with Powell’s more measured approach, leading to criticisms from the President about the Fed’s pace of economic stimulus. This discord underscores the broader challenge of maintaining the Federal Reserve’s independence amid political pressures, as Powell must balance the demands of the administration while fulfilling the Fed’s economic responsibilities. As Trump’s presidency began to wind down, the question of Powell’s future, especially in light of the political landscape and potential successor candidates, remained a topic of speculation, impacting market dynamics and economic forecasts.

Future Prospects for the Federal Reserve’s Leadership

As the landscape surrounding the Federal Reserve continues to evolve, the future prospects for its leadership, particularly regarding Jerome Powell, evoke considerable discussion among economists and market analysts. The landscape is particularly nuanced given that Powell’s term is set to expire soon, and the dynamics between the central bank and the executive branch remain tense. Investors and analysts speculate about potential successors and their monetary policy philosophies, weighing how a new chair could impact interest rates and broader economic strategies. The uncertainty regarding Powell’s future creates anxiety in the markets, as stakeholders grapple with the implications of potential policy shifts under new leadership.

The debate around the Fed’s crucial role in managing the economy highlights the broader implications of its leadership on market performance. Should President Trump opt to nominate a replacement, the emphasis on who may succeed Powell becomes paramount because it signals the administration’s stance on monetary policies moving forward. The ideal successor would need to be someone capable of instilling confidence among investors in their ability to navigate the complex economic backdrop while also maintaining the Fed’s independence, ensuring that public trust in the institution remains intact.

Additionally, the landscape surrounding the Fed’s leadership extends to discussions about the implications of political actions on economic frameworks. With the Federal Reserve acting as a central pillar in the U.S. financial ecosystem, the choices made regarding its leadership can have far-reaching consequences. As such, the forthcoming decisions surrounding Powell’s potential replacement will not only reflect the administration’s priorities but also influence how markets perceive the stability and reliability of U.S. monetary policy in years to come. Stakeholders across various sectors will continue to monitor these developments closely, recognizing that the leadership dynamics within the Fed will shape the trajectory of economic health, particularly concerning inflation, growth, and employment.

Frequently Asked Questions

Can Trump fire Jerome Powell as Fed Chairman?

Yes, President Trump can technically remove Jerome Powell, the Federal Reserve Chairman, but doing so would raise significant legal and market concerns. The Federal Reserve Act allows for removal ‘for cause’, yet there is ambiguity regarding whether this applies to the chair’s four-year term. Removing Powell could undermine the Federal Reserve’s independence and lead to a negative market reaction.

What was Trump’s relationship with Fed Chairman Jerome Powell?

President Trump’s relationship with Fed Chairman Jerome Powell has been contentious. While Trump nominated Powell in 2017, he frequently criticized Powell for not cutting interest rates aggressively enough and expressed dissatisfaction with the Fed’s monetary policy decisions, particularly during times of economic uncertainty.

How has Trump’s economic policy influenced Jerome Powell’s decisions?

Trump’s economic policies, including global tariffs and trade strategies, have pressured the Federal Reserve and influenced Powell’s decisions on interest rates and monetary policy. Trump’s calls for lower rates often clash with Powell’s focus on long-term economic stability, which aims to control inflation.

What would happen to the Federal Reserve if Trump fired Powell?

If Trump were to fire Jerome Powell, it could severely impact the Federal Reserve’s credibility and independence. Markets might react negatively, fearing that the replacement would pursue a looser monetary policy focused on short-term economic growth rather than maintaining long-term stability.

What are the legal arguments related to Trump potentially removing the Fed Chairman?

Legal arguments about Trump’s potential removal of the Fed Chairman center on statutory interpretation of the Federal Reserve Act. The act does not clearly define the grounds for removing the FOMC chair, leading to speculation about the limits of presidential power over independent agencies. The Supreme Court’s interpretation of executive authority could further influence this issue.

Why would Wall Street be worried about the removal of the Fed Chairman?

Wall Street would be concerned about the removal of Fed Chairman Jerome Powell because it could signal a shift towards more accommodative monetary policy, potentially leading to higher inflation. This change could undermine market confidence in the Fed’s commitment to controlling inflation and maintaining stable interest rates.

What role does the Fed Chairman play in monetary policy?

The Fed Chairman plays a critical role in shaping U.S. monetary policy, overseeing internal deliberations, and guiding discussions within the Federal Open Market Committee (FOMC). While the chairman is influential, effective policymaking also requires building consensus among committee members.

Could a replacement for Powell reassure the markets?

While a replacement for Powell might be viewed favorably if they have a credible reputation, market reassurance would more likely depend on the context of the removal. Markets would interpret the act of removal itself as a signal of policy changes, potentially causing more anxiety about future monetary policy.

| Key Point | Explanation |

|---|---|

| Trump’s Relationship with Powell | Trump’s nomination of Powell in 2017 led to a complicated relationship, marked by disagreements on monetary policy. |

| Possibility of Removal | Legal experts suggest Trump can try to remove Powell, but it would likely harm the Fed’s independence and lead to market instability. |

| Legal Grounds for Removal | The Federal Reserve Act provides limited grounds for removal, complicating Trump’s authority. |

| Market Reaction | Markets fear a change in leadership could signal a shift towards looser monetary policy, risking inflation. |

| Importance of Independence | The Fed’s independence is crucial for maintaining credibility and managing inflation effectively. |

| Potential Successor Ineffectiveness | Removing Powell might not ease market concerns, as investors would interpret it as a move towards more lenient monetary policy. |

Summary

Trump Fed Chairman concerns reflect deep-rooted tensions between presidential authority and the Federal Reserve’s independence. The balance between influencing economic growth and maintaining credible inflation control is pivotal, as any attempt by Trump to remove Chairman Powell could unsettle markets and question the Fed’s stability. Therefore, the pursuit of strategic economic policy must carefully navigate these dynamics.