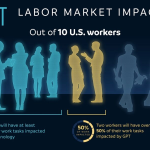

The impact of research funding on startups is a crucial topic, especially in today’s rapidly evolving innovation ecosystem. As cuts to research funding, particularly in prestigious institutions like Harvard, become more pronounced, the ramifications for emerging startups could be dire. Without adequate funding, these entrepreneurial ventures struggle to translate scientific breakthroughs into market-ready products, stifling economic growth. Additionally, venture capitalists often look for promising research as a bellwether for investment opportunities, thereby linking startup success directly to the vitality of research funding. Ultimately, a sustained deterioration in funding not only threatens individual startups but could also compromise the overall health of the U.S. economy.

Exploring the influence of financial support for scientific inquiry on new business ventures reveals critical insights into the startup landscape. The availability of funding for innovative research plays a vital role in nurturing entrepreneurial activities, particularly within academic settings like Harvard. As universities serve as incubators for innovation, any disruptions in their funding sources can lead to decreased entrepreneurial output, which in turn affects employment and economic dynamics. Additionally, when research funding is curtailed, the connection between academic research and successful business startups may weaken, limiting growth opportunities for the broader economy. Understanding this interplay is essential as stakeholders analyze how investment in research can fuel not just innovation, but also the next wave of business opportunities.

The Role of Research Funding in Startup Innovation

Research funding plays a pivotal role in enabling startups to transform innovative ideas into viable products and services. In institutions like Harvard, significant resources are allocated to research, with funds primarily coming from federal grants and venture capital investments. These resources don’t just enhance laboratory capabilities but also provide aspiring entrepreneurs with the tools and mentorship necessary to navigate the complex landscape of launching a business. The correlation between robust research funding and the emergence of successful startups underlines the importance of financial support in fostering an innovation ecosystem.

Furthermore, the beneficial impact of research funding extends beyond just immediate financial support; it catalyzes the development of a groundbreaking culture. For instance, universities equipped with well-funded research labs produce groundbreaking technological advancements in fields such as biotechnology and artificial intelligence. Startups can leverage these advancements, often born within academic settings, to create new market opportunities—success stories that count on well-funded research initiatives to thrive. The potential loss of funding jeopardizes this cycle, threatening the very essence of innovation that drives economic growth.

Impact of Research Funding Cuts on Startups

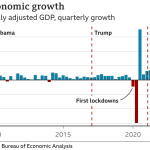

Cuts in research funding present a formidable challenge to startups, which frequently rely on federal grants to underpin their development phases. The recent freeze on federal funding at institutions like Harvard sends ripples through the startup ecosystem, potentially curtailing the number of innovative enterprises that emerge from these academic havens. Economists have projected that such cuts could shrink the GDP significantly, drawing parallels to economic downturns experienced in the past, such as the Great Recession. In this context, the current funding climate poses risks not only to established startups but also to nascent ventures that could be potential leaders in innovation.

Moreover, the long-term implications of these funding cuts could reshape the entrepreneurial landscape drastically. As research initiatives face suspensions or cancellations, the pipeline that brings new startups into fruition will likely dwindle. Early-stage ventures often depend on a flow of innovative ideas from academic settings to drive their value propositions. Without consistent research funding, the entrepreneurial spirit could suffer from a lack of new ideas and technologies, leading to fewer successful startups in the market and ultimately stunting economic growth.

The Importance of Harvard Startups in the Innovation Ecosystem

Harvard startups exemplify the synergy between higher education and the entrepreneurial sector, showcasing how institutions of learning can act as incubators for innovation. The university’s comprehensive entrepreneurship curriculum and proactive support mechanisms foster an environment where students can transform theoretical knowledge into real-world applications. Startups emerging from Harvard have the potential to make substantial impacts in various industries, benefiting from both the university’s resources and the diverse expertise of its faculty.

Moreover, these startups thrive in a well-established innovation ecosystem fueled partly by collaboration between academia and the venture capital community. Funding from venture capitalists—who often have a vested interest in the commercial potential of research breakthroughs—couples with Harvard’s intellectual resources to produce cutting-edge solutions. As these startups grow, they contribute to job creation, technological advancements, and the overall stimulation of the economy. Therefore, maintaining research funding is not just beneficial but crucial for the continuous success of Harvard startups in the global marketplace.

Venture Capital’s Relationship with Research Funding

Venture capital plays a critical role in bridging the gap between innovative research and market application. Many venture capitalists invest heavily in startups that emerge from prestigious research institutions like Harvard, recognizing the inherent value of cutting-edge research and development. When research funding is stable, it lays a robust foundation for startups, making them more attractive investment opportunities for venture capitalists. This interdependence fosters an environment where innovation can flourish, driving economic growth by creating companies that change industries.

However, disruptions to research funding can create a chilling effect on this investment dynamic. For example, recent funding cuts have led to uncertainty in the startup ecosystem, making venture capitalists cautious about investing in newly formed companies that lack solid backing from research initiatives. As a result, startups may face difficulties in securing the necessary capital to scale their operations and continue innovating. A thriving innovation ecosystem requires seamless integration between research funding and venture capital, and disruptions in either can adversely impact the potential of emerging tech and biomedical startups.

The Economic Growth Implications of Research Funding

Research funding is intricately linked to economic growth, acting as a catalyst for job creation, technological advancements, and entrepreneurial success. As universities and research institutions receive financial support, they invest in cutting-edge research projects and foster environments ripe for experimentation and innovation. For example, the data showing that biomedical research generates approximately $2.56 in economic activity for every dollar invested highlights the profound impact of research funding on national economic health.

When research budgets are threatened, as seen with the recent funding cuts, the consequences can resonate throughout the economy. Startups reliant on research innovations may find themselves stunted in growth or unable to commence operations, which can lead to job losses and decreased competitiveness on a national scale. Therefore, maintaining robust levels of research funding should be a policy priority, not only to sustain the innovation ecosystem but also to secure long-term economic prosperity.

The Ripple Effects of Funding Freezes on Startup Incubation

Funding freezes at major research institutions like Harvard can have severe ripple effects throughout the startup ecosystem. As initiatives and grants are put on hold, the immediate impact translates into fewer resources for aspiring entrepreneurs and researchers. Startups that depend on fresh ideas and collaboration are likely to face severe setbacks if their access to cutting-edge research is diminished. Consequently, the pipeline through which innovative startups emerge could stall, leading to a decrease in the overall dynamism of the market.

As the innovation cycle is disrupted, the long-term effects of such funding freezes could manifest in the form of reduced startup formation and weakened entrepreneurial activity. With less research activity and fewer initiatives being funded, we are likely to see a decline in the quality and number of startups being incubated over time. The trajectory of innovation greatly depends on the ongoing support of research funding; thus, whenever funding is cut, the entire startup culture stands to suffer.

Navigating the Future Landscape of Research and Innovation

As we look forward, navigating the future landscape of research and innovation amid funding uncertainties will require proactive measures from various stakeholders, including universities, governmental agencies, and venture capitalists. It’s essential that institutions fortify their relationships with funding bodies and advocate for the continued importance of research investments. On their part, universities must leverage their strengths, showing the tangible impacts of funded research on economic growth and innovation.

Collaboration will be key; partnerships between academia, industry, and government could create new avenues for funding and innovation. By integrating more commercial thinking into academic research paradigms, we can ensure that groundbreaking discoveries move seamlessly from the laboratory to the marketplace, thereby fostering a resilient innovation ecosystem. Ultimately, the sustainability of startups in the face of funding challenges lies in a concerted effort to advocate for and protect research funding as an essential engine for growth and progress.

Fostering a Resilient Startup Ecosystem

Building a resilient startup ecosystem requires a multifaceted approach that includes securing research funding and encouraging collaboration among various sectors. By investing in emerging technologies and providing open channels for dialogue between academia and industry, we can cultivate environments where startups can thrive. This can be achieved through programs that facilitate exchange programs between researchers and entrepreneurs, or by creating facilities that support pilot projects and initial phases of product development.

In addition, fostering a culture of innovation and entrepreneurship within research institutions will be pivotal. Encouraging institutions to promote entrepreneurial mindset among researchers and students can lead to dynamic growth of startups. Empowering faculty and student-led projects with adequate resources can stimulate more ventures that translate research findings into commercial successes, ensuring that the startup ecosystem not only survives but thrives amid challenges.

Frequently Asked Questions

What is the impact of research funding cuts on startups in the U.S.?

Cuts to research funding can severely hinder startups by limiting access to innovative ideas and technologies that emerge from universities. A reduced funding environment results in fewer resources for research and development, stifling the entrepreneurial ecosystem crucial for transitioning scientific advancements into market-ready solutions.

How does federal research funding contribute to economic growth through startups?

Federal research funding is pivotal for fostering economic growth because it cultivates an environment for innovation. Startups rely on federally supported research to develop new technologies. For every dollar invested in biomedical research, there is a significant return in economic activity, which stimulates growth and job creation in the startup sector.

What role do research universities play in supporting Harvard startups?

Research universities, like Harvard, are integral to the startup ecosystem by providing resources, mentorship, and an innovative curriculum. They foster entrepreneurial spirit among students and faculty, leading to the commercialization of research breakthroughs and the establishment of successful startups.

Why are research funding and venture capital important for the innovation ecosystem?

Research funding and venture capital are crucial for the innovation ecosystem as they provide the necessary financial support to turn creative ideas into viable businesses. Research funding nurtures new discoveries, while venture capital helps scale startups, driving technological advancement and economic growth.

What long-term effects can we expect from the freeze on federal funding for startups?

The freeze on federal funding is likely to lead to long-term effects, including a decline in the number of innovative startups. This situation could hinder the pipeline of new companies for one to three years, ultimately impacting the U.S. entrepreneurship landscape and economic stability.

How does the loss of research funding impact Harvard’s entrepreneurial initiatives?

The loss of research funding at Harvard threatens its entrepreneurial initiatives by reducing the financial resources available for research and innovation. This can lead to fewer successful startup launches and a decrease in the overall vibrancy of the entrepreneurship curriculum.

Can the economic effects of research funding cuts on startups be reversed?

While it is possible to reverse the economic effects of research funding cuts, it will take time. Recovery could take one to three years as the pipeline for startup creation is disrupted, slowing the transition from lab research to market-ready innovations.

| Key Points |

|---|

| Federal funding cuts threaten research and innovation at universities, affecting the U.S. economy. |

| Harvard University faced over $2 billion in frozen grants due to political conflicts, impacting research operations. |

| Reduction in research funding may shrink the U.S. GDP by 3.8%, comparable to the Great Recession. |

| Research universities, like Harvard, play a critical role in launching successful startups by connecting faculty research with student entrepreneurship. |

| The effects of funding freezes will delay the emergence of startups, with significant impacts expected in the coming years. |

| Federal funding is crucial for labs to innovate and attract top-tier talent, fostering an environment for entrepreneurship. |

Summary

The impact of research funding on startups is profound, as disruptions in funding can hinder innovation and economic growth. Without adequate federal support, the ability of universities to incubate new ventures is compromised, which could lead to fewer innovative companies entering the market. As seen with current funding cuts, the delay in startup formation can have long-term consequences on the economy. To maintain the momentum of U.S. entrepreneurship, it is essential to recognize and rectify these funding challenges.