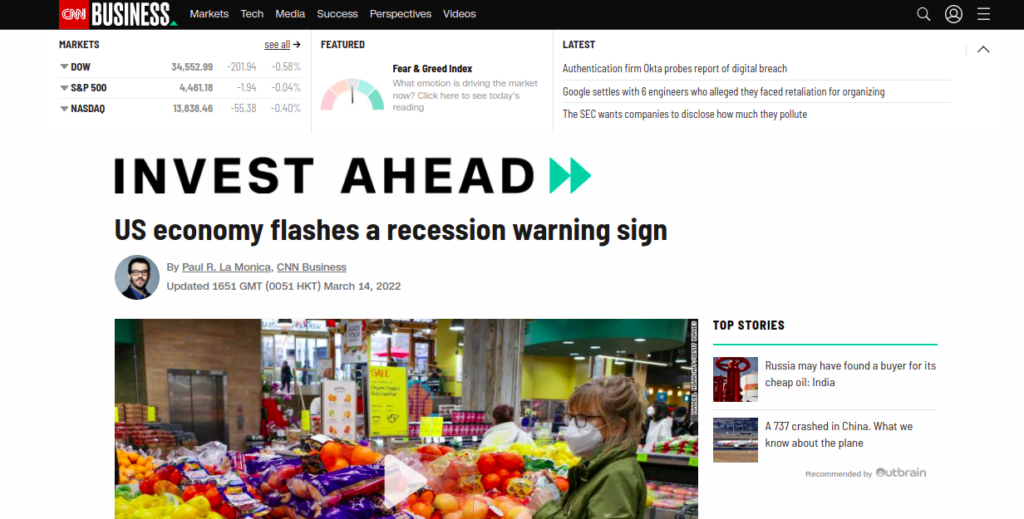

A recent U.S. economy recession warning has raised alarms among economists and investors alike, with potential implications that could ripple through the market. As geopolitical tensions escalate, particularly the impact of the ongoing trade war, concerns about economic stability are mounting. The Federal Reserve’s deliberations on interest rates are increasingly critical amidst falling consumer sentiment index levels, highlighting economic uncertainty. Additionally, stock market volatility is a concern, as investors wrestle with the risks of a potential downturn. This confluence of factors calls for close attention to economic indicators as the nation navigates these turbulent waters.

As we assess America’s financial landscape, the prospect of an economic downturn is becoming a pressing topic among analysts. With descriptors like financial slowdown and possible recession roaming the discourse, many are scrutinizing how external factors such as global trade tensions are influencing market stability. The impacts of the Federal Reserve’s monetary policies, especially concerning interest rates, are under the microscope, especially as consumer confidence wavers. Economic unpredictability and significant fluctuations in the stock market suggest that caution may be warranted in the coming months. Understanding these dynamics is crucial for both investors and policymakers aiming to mitigate potential repercussions.

The Looming Threat of U.S. Economy Recession

Recent changes in U.S. trade policies have sparked concerns among economists about the potential for a recession. The ongoing trade war, particularly with key partners like China and Canada, has manifested in retaliatory tariffs that threaten American exports. Many analysts argue that prolonged economic uncertainty—stemming from these tariffs—could hinder consumer confidence and business investments. This precarious situation is exacerbated by a declining consumer sentiment index, suggesting that families may start tightening their budgets in anticipation of tougher economic times.

Furthermore, the volatility seen in the stock market serves as another indicator of economic distress. As stocks tumble amid fears of a trade conflict escalation, the risk perception among investors has heightened. Should this trend continue, businesses may cut back on hiring, further inhibiting economic growth and potentially leading to a recession. Central to this discussion is the role of the Federal Reserve, which is facing pressure to adjust interest rates in response to fluctuating economic indicators. Whether to stimulate growth through lower rates or maintain them to control inflation presents a complex challenge.

Impact of Trade War on U.S. Economy

The current trade war initiated by tariff impositions has widespread implications on the U.S. economy. Economists largely agree that tariffs can lead to increased prices for consumers, reduced purchasing power, and a slowdown in economic growth. As tariffs escalate, the likelihood of retaliatory measures from affected countries remains high, creating an environment marred by uncertainty. For businesses heavily reliant on foreign supply chains, this uncertainty can disrupt operations, leading to layoffs and a potential downturn.

Moreover, the cascading effects of this trade war extend beyond immediate financial metrics. As companies reevaluate their market strategies in response to tariffs, consumer sentiment may further decline. If consumers perceive the economy negatively, they are less likely to make discretionary purchases, leading to a decrease in demand and potentially stalling economic recovery. In the worst-case scenario, if the trade situation remains unresolved, we could see a chain reaction culminating in a recession.

Understanding Federal Reserve Interest Rates Amid Economic Uncertainty

The Federal Reserve finds itself at a crossroads as it navigates the present economic landscape rife with uncertainty. With inflation persisting and economic growth stalling due to external pressures like the trade war, the Fed’s decisions on interest rates carry significant weight. Lowering interest rates could encourage borrowing and spending, crucial for stimulating economic activity, especially with rising worries about the direction of the market. Alternatively, maintaining higher rates might be necessary to keep inflation from spiraling out of control in times of uncertainty.

In light of the recent consumer sentiment index showing a decrease in economic optimism, the Fed’s approach may have to remain cautious. If they opt to lower rates too soon or too drastically, they risk triggering higher inflation and destabilizing the market further. Additionally, the ongoing volatility in stocks and the potential for job losses cast a shadow over any decision—exacerbating the careful balance the Fed must strike between fostering economic growth and maintaining price stability.

Navigating Stock Market Volatility and Its Economic Implications

Stock market volatility has reached concerning levels as investor sentiment grows increasingly fragile amid ongoing trade tensions. The fluctuation of stock prices not only impacts market wealth but also serves as a barometer for overall economic health. As businesses contend with unstable stocks and uncertain profit forecasts, many are reassessing their long-term strategies, which could lead to a slowdown in hiring and investment.

The relationship between stock market performance and consumer behavior is well documented; rising stock prices tend to encourage spending, while volatility can trigger a ‘wait and see’ approach from consumers. With the recent losses across major indexes, a dip in consumer spending may be on the horizon, further exacerbating worries of a recession. As we analyze these trends, the importance of stability in the stock market and its correlation with consumer confidence becomes unmistakably clear.

Consumer Sentiment Index: A Key Indicator for Economic Outlook

The University of Michigan’s consumer sentiment index is one of the most reliable indicators of economic outlook, reflecting how households view their financial prospects and the overall economy. As it recently hit lows not seen since late 2022, analysts express heightened concern. A declining index generally correlates with reduced consumer spending, which can slow down economic growth and potentially lead to recessionary conditions.

Given that consumer confidence is directly tied to economic performance, any significant drops can trigger a series of negative effects—businesses may cut back on hiring or delay investments, further hurting economic growth. For policymakers and the Federal Reserve, monitoring consumer sentiment is crucial for anticipating shifts in inflation and spending patterns, enabling them to adjust their strategies and support the economy effectively.

Assessing Economic Uncertainty: Challenges Ahead

Economic uncertainty presents a myriad of challenges that can destabilize various sectors of the economy. As businesses face potential changes in trade policies, escalating tariffs, and unpredictable government spending, a cloud of uncertainty hangs over investment decisions. Firms may choose to delay capital expenditures or hiring, further compounding risks of recession. The fear of an impending downturn can create a self-fulfilling prophecy, where reduced spending leads to actual declines in economic performance.

Moreover, growing perceptions of risk among consumers and investors alike can lead to a broader economic slowdown. As risk sensitivity increases, people often retreat to saving rather than spending, impacting businesses reliant on consumer cash flows. In this unpredictable environment, economic resilience hinges on addressing these uncertainties and fostering an atmosphere conducive to growth and stability.

Long-Term Effects of Current Tariff Policies on U.S. Economy

The implementation of current tariff policies may reverberate through the U.S. economy for years to come. Initially aimed at protecting domestic industries, these tariffs risk fostering retaliatory measures from trading partners, complicating global trade dynamics. This ripple effect could create long-term challenges for U.S. exporters and disrupt established supply chains, ultimately impairing economic efficiency and driving up prices for consumers.

In the long run, if these tariffs continue unabated, they may inhibit economic growth by discouraging foreign investment. Businesses may relocate operations to countries with more favorable trade environments, undermining job creation in the U.S. Thus, the current tariff strategies must be carefully evaluated against their potential for causing enduring harm to the U.S. economy while balancing the immediate needs of domestic industries.

The Federal Reserve’s Strategy for Stemming Inflation Amid Economic Slowdown

Amid increasing inflation and economic slowdown projections, the Federal Reserve’s strategy for interest rates becomes more critical. As inflationary pressures mount, the Fed must exercise a delicate balance—cutting rates to stimulate growth while preventing overheating that further exacerbates inflation. Strategic rate cuts could potentially provide the much-needed support for struggling consumers and businesses while also alleviating some of the burdens caused by heightened prices.

However, the Fed’s options are limited in a landscape characterized by external shocks and domestic policy chaos. The intricacies of managing inflation in tandem with a faltering economy challenge conventional economic models. Ultimately, the Fed’s response will profoundly influence both investor confidence and consumer behavior, underscoring the interconnectedness of monetary policy with broader economic health.

Looking Forward: Potential Recovery Strategies for U.S. Economy

In light of the current economic turmoil marked by trade wars and market volatility, the path to recovery for the U.S. economy will require adaptive strategies from policymakers. Emphasizing collaboration with both domestic businesses and international partners can help alleviate tensions and forge ahead into a more stable economic environment. Innovative fiscal policies, targeted measures for impacted sectors, and a reevaluation of tariff strategies may prove essential in resurrecting growth.

Moreover, economic recovery will also hinge on restoring consumer confidence. Efforts to address economic uncertainty in a constructive manner—through transparent communication, effective fiscal measures, and government support—are vital. Ensuring that consumers feel secure in their financial futures will bolster spending and, in effect, contribute to a revitalized economy.

Frequently Asked Questions

What are the implications of the U.S. economy recession warning on consumer sentiment index?

The U.S. economy recession warning highlights a decline in the consumer sentiment index, indicating that consumer confidence is waning. When people feel uncertain about their financial future, they tend to reduce spending, which can exacerbate economic downturns and potentially lead to recession.

How does the trade war impact the U.S. economy recession warning?

The trade war significantly contributes to the U.S. economy recession warning by creating economic uncertainty. Tariffs imposed on American goods by countries like China, Mexico, and Canada can lead to retaliatory measures, disrupting trade and potentially slowing economic growth, thereby increasing the risk of recession.

What role do Federal Reserve interest rates play in a U.S. economy recession warning?

Federal Reserve interest rates are crucial in shaping economic conditions. In the context of a U.S. economy recession warning, the Fed may consider cutting interest rates to support growth. However, if inflation persists, maintaining or raising rates may be necessary, creating a challenging dilemma in managing economic stability.

Why is stock market volatility a concern during a U.S. economy recession warning?

Stock market volatility is a major concern during a U.S. economy recession warning because sharp declines in stock prices can erode consumer wealth and confidence. This loss can lead investors to reduce spending and increase savings, further weakening the economy and potentially leading to recession.

What are the effects of economic uncertainty on the U.S. economy during a recession warning?

Economic uncertainty can severely impact the U.S. economy during a recession warning by causing businesses and consumers to delay spending and investment decisions. This hesitation can slow economic activity, reduce job growth, and increase the likelihood of a recession.

| Key Point | Details |

|---|---|

| U.S. Economy Status | Concerns of a recession due to tariffs, low consumer sentiment, and potential market instability. |

| Impact of Tariffs | Tariffs are widely considered harmful by economists, potentially hurting investments and reducing market confidence. |

| Consumer Sentiment | The University of Michigan’s consumer sentiment index hit its lowest since November 2022. |

| Factors Leading to Recession | Potential factors include trade war, stock market crash, government spending cuts, fiscal crisis, and increased risk perception. |

| Federal Reserve Actions | The Fed may struggle to balance rate cuts to support economy while managing inflation concerns. |

Summary

The U.S. economy recession warning is increasingly palpable as various economic indicators point towards a potential downturn. Current market volatility, driven by trade tensions and low consumer sentiment, raises fears of a recession in the near future. With critical factors such as government spending cuts and heightened risk perceptions contributing to this uncertainty, it is crucial for policymakers to navigate these challenges carefully. Investors, businesses, and consumers must remain vigilant as the landscape evolves.